If you want to save time not scouring the internet for complicated solutions,

If you have no idea how to make extra money effortlessly in the world of cryptocurrency,

And if you’d rather achieve financial gains without the hassle,

Then this is for you.

WHAT it is:

NiceHash, a revolutionary platform simplifying cryptocurrency mining by allowing users to earn Bitcoin by renting out their computing power.

WHY it’s amazing: NiceHash delivers a seamless way to earn extra income in the form of Bitcoin, providing a passive income stream that benefits anyone looking to boost their financial portfolio.

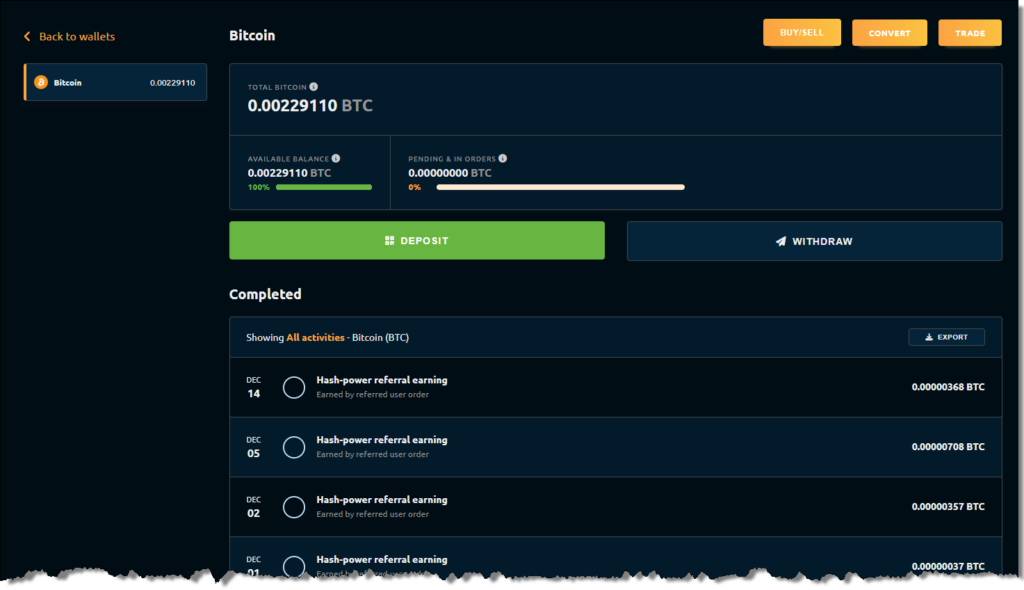

Let me share my personal journey of making $100 in free Bitcoin by referring people to NiceHash.

First of all – I totally underestimated the importance of referring people to the amazingly simple solution of NiceHash.

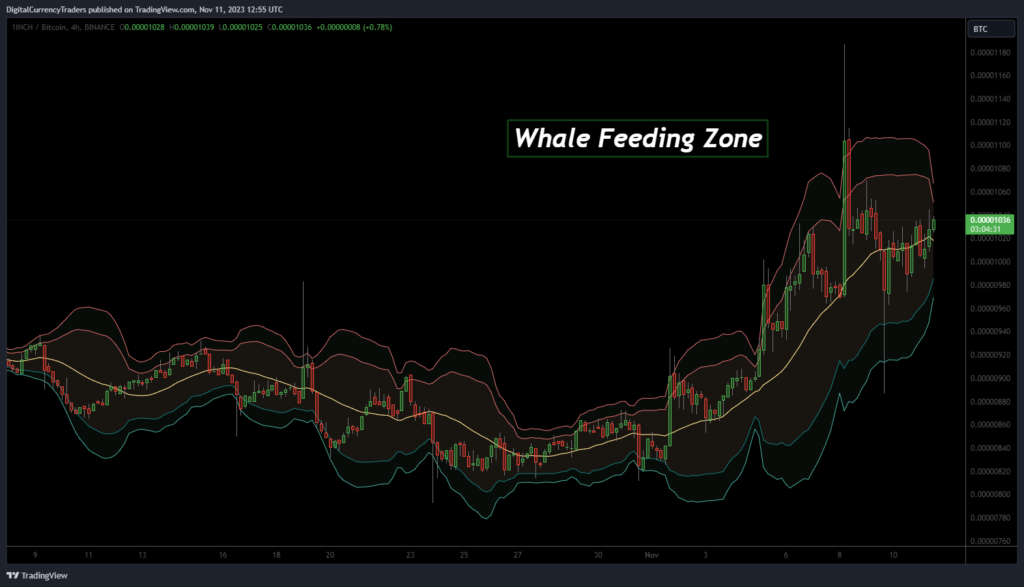

NiceHash is a cryptocurrency mining marketplace where you can rent out your computer’s processing power (CPU, GPU) to miners.

Miners pay you in Bitcoin for this service.

The more powerful your computer, the more you can earn.

The NiceHash Miner software automatically selects the most profitable cryptocurrency to mine at any given time, maximizing your earnings.

Crypto Mining Used To Be Hard

Before – Without NiceHash, you would have to navigate the complex world of cryptocurrency mining on your own, which could be time-consuming and confusing.

After – With NiceHash, you have a platform that simplifies the process, providing you with the tools and services you need to mine and trade cryptocurrencies effectively and efficiently.

Now it is easy to start making money and earn passive income paid in Bitcoin.

Case Study

One user on Reddit shared their experience with NiceHash, explaining that as long as you download the software from the official site, it is safe to use.

They also clarified that antivirus programs often flag CPU mining software as viruses, but this is due to past malware issues and not a reflection of NiceHash’s trustworthiness.

How it Works

To start earning with NiceHash, you need to download and install the NiceHash Miner software on your computer.

Once installed, the software will benchmark your computer’s processing power and automatically start mining the most profitable cryptocurrency.

You can monitor your earnings and withdraw your Bitcoin from the NiceHash website.

Step 1: Sign up for a NiceHash account.

Step 2: Download the NiceHash Miner, their proprietary Excavator, or open-source xmrig.

Step 3: Start mining cryptocurrencies using your computer’s processing power.

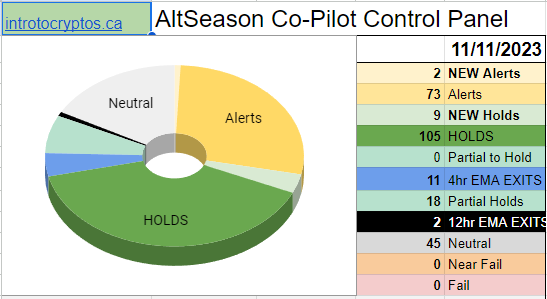

Step 4: Monitor your earnings and hashrate history through the History & Stats settings page.

Step 5: Trade or sell your mined cryptocurrencies on the NiceHash marketplace.

How Can I Make The Most Money?

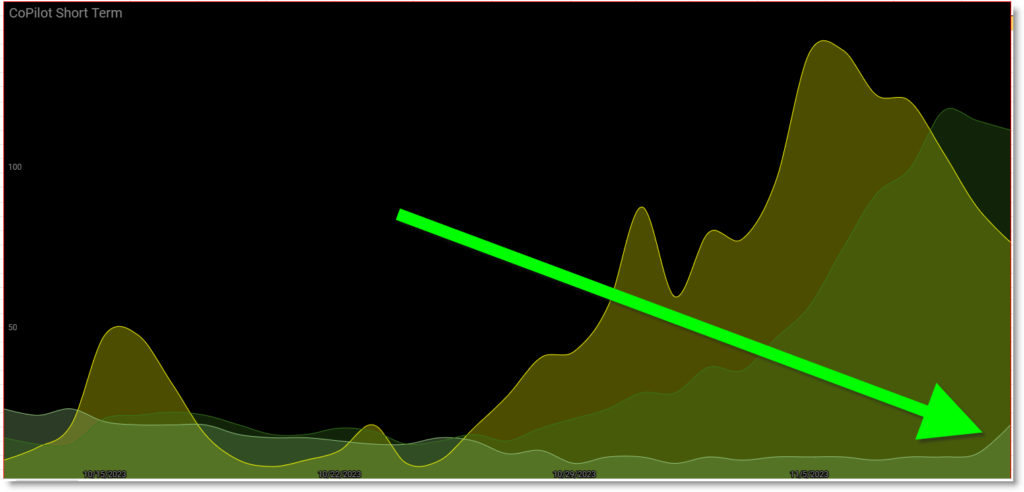

Don’t mine at all. Refer people to NiceHash and earn passive income. Like me.

The profitability of mining with NiceHash depends on several factors, including the power of your GPU, the cost of electricity in your area, and the current market rates for the cryptocurrencies being mined.

You can use the NiceHash profitability calculator to estimate your potential earnings.

Best practices for maximizing your earnings with NiceHash include keeping your GPU drivers up to date, ensuring your computer is well-ventilated to prevent overheating, and running the NiceHash Miner software during times when electricity rates are lower.

What Do I Need To Get Started?

How to make the most from mining? Don’t mine. Just refer people to buy the computer equipment on Amazon and earn passive income. Like me.

To become a NiceHash miner, focusing on the specific hardware (GPU, CPU, RAM, etc.) and storage space—here’s a 2024 guide based on the information available:

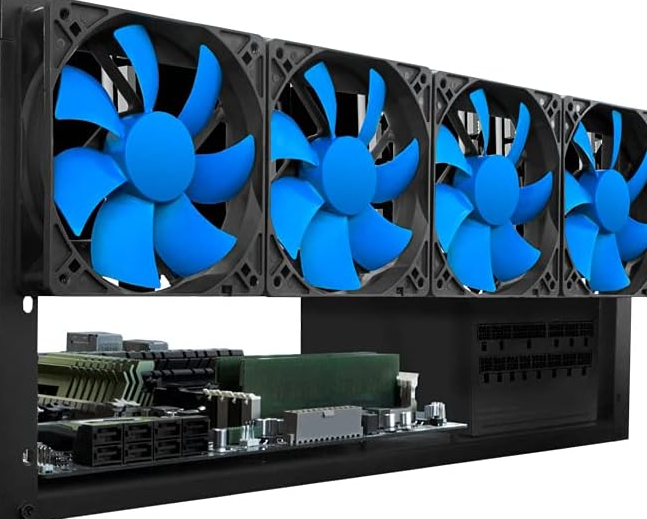

Hardware Requirements

GPU:

- Minimum VRAM: For GPU mining, having at least 6GB of GDDR5 memory (VRAM) is crucial. NiceHash QuickMiner supports and runs on all NVIDIA® 1000, 2000, 3000 series GPUs with at least 6GB of GDDR5 memory2.

- Recommended GPUs: For efficient mining and decent profit, higher-end GPUs are recommended. As of the latest insights, Nvidia’s 4000 series GPUs are suggested for their efficiency.

CPU:

- While specific CPU requirements are not heavily emphasized, having a modern CPU that can support Windows 10 is necessary for running mining software smoothly.

RAM:

- Minimum RAM: At least 4GB of system RAM is recommended to run Windows 10 and the mining software without issues.

- Virtual RAM: If you’re running multiple GPUs, it’s advised to increase your virtual RAM based on the total memory of your GPUs. For instance, if you have GPUs with a total of 8GB VRAM, setting your virtual RAM to at least 8000MB is recommended.

Storage Space

- Minimum Storage: A 240GB SSD is sufficient for running Windows 10 and NiceHash mining software, but be mindful of storage space as it can get filled up with temporary files or updates.

- NiceHash OS: For those opting to use NiceHash OS, a modest 4GB USB stick is adequate since NHOS loads itself into RAM upon boot, minimizing the reliance on the boot media during mining operations.

Additional Considerations

- Operating System: Windows 10 is commonly used for NiceHash mining due to its compatibility and ease of use. However, NiceHash OS is an alternative for those looking for a dedicated mining OS.

- Cloud Storage Provisioning: Large scale hard drive file server to participate in STORJ decentralized earning.

- Internet Connection: A stable and reliable internet connection is essential for uninterrupted mining and communication with the NiceHash servers.

Conclusion

Becoming a NiceHash miner requires meeting certain hardware and storage specifications to ensure efficient and profitable mining operations.

It’s important to have a capable GPU with sufficient VRAM, at least 4GB of system RAM (with additional virtual RAM for multiple GPUs), and adequate storage space for the operating system and mining software.

How I Earned $100 in Free Bitcoin With Zero Invested

Making money on NiceHash may nothing to do with mining.

You can just refer new miners to the equipment and to NiceHash. They are making money, and you are making money.

By meeting these requirements, you can set up your mining rig to start earning through the NiceHash marketplace – or you can teach others how to set up rigs on NiceHash… and start making money and earning passive income paid to you in Bitcoin.