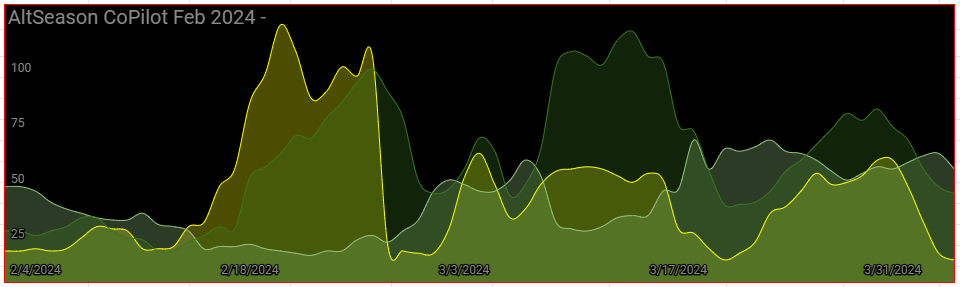

The AltSeason CoPilot suggests a cautiously bullish outlook for altcoins.

April 4 2024 Altcoin Season Update

Altcoin season represent periods when altcoins significantly outpace Bitcoin in terms of price increases. The AltSeason CoPilot looks inside market indicators such as Bitcoin dominance and stable coin trends, to help traders plan for trend changes in the ALT/BTC price spreads.

April 4 update from the

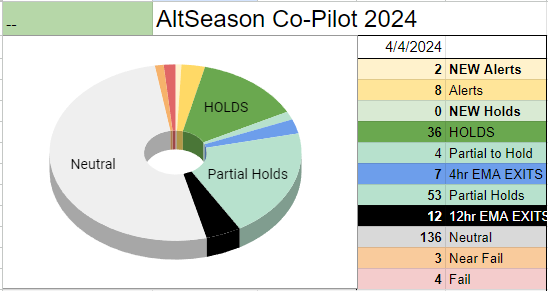

AltSeason CoPilot daily action matrix:

On the bullish side,

2 new coins into the “New Alert” status, traders have indicators that new potential opportunities are emerging in the market.

No new coins have been added to the “New Hold” status, which suggests a wait-and-see approach for newly tracked coins.

However, the shift of 4 coins into the “Partial to Hold” status indicates that certain altcoins are maintaining their bullish momentum and may be worth retaining in one’s portfolio for the time being.

On the bearish side,

There are signs of potential downsides or profit-taking opportunities with 7 coins shifting into the “Partial Exit” status and 12 coins moving into the “Exit” status.

These figures signal that several cryptocurrencies may have reached their peak or are exhibiting weakening trends, prompting a strategic exit.

For clarity, here is a formatted table summarizing the current actions as per the daily action matrix from the AltSeason CoPilot:

| New Alert | New Hold | Partial to Hold | Partial Exit | Full Exit |

|---|---|---|---|---|

| 2 | 0 | 4 | 7 | 12 |

The AltSeason CoPilot’s proven crypto trading plan emphasizes risk control strategies that are paramount when navigating these seas of change.

Traders are reminded to not only focus on individual asset performance but also to consider overall market trends, Bitcoin dominance, and stable coin movements as indicators of broader investor sentiment.

A conservative approach—one that takes advantage of diversification and focuses on tiny positions for long-term trends—continues to be the cornerstone of trading safely in the altcoin market.

Get Started

Join thousands and learn to profit from trend trading.

AltSeason in April

Recent cryptocurrency news has been buzzing with various developments and speculations. Here’s a summary of the top cryptocurrency news from April 2024, quoting top sources from Reddit and Twitter:

- Meme Coin Rally: A significant rally in meme coins such as DOGE, SHIB, BONK, PEPE, and WIF has been observed, which analysts from K33 Research suggest could be an early sign of an impending altcoin season. They also note that Ether (ETH) breaking above $3,500 could confirm the start of altcoins outperforming Bitcoin (BTC)1.

- Bitcoin Halving Anticipation: The Bitcoin community is eagerly anticipating the upcoming halving event, scheduled for April 19th or 20th. Discussions on Reddit reflect a mix of excitement and skepticism, with some users predicting a massive bull run while others urge caution37.

- Altcoin Season Index: Technical analyst Kyle du Plessis from the Crypto Banter YouTube channel has indicated that various indicators show the altcoin season has just begun and could continue for the next eight weeks. The altcoin season index is reportedly at a value of 76, where 75 marks the beginning of an altcoin season. 4.

What is the difference between the altseason index and the altseason copilot?

The AltSeason Index and the AltSeason CoPilot are tools designed to assist traders in navigating the cryptocurrency market, specifically focusing on alternative cryptocurrencies (altcoins) beyond Bitcoin.

However, they serve different purposes and operate based on distinct principles.

AltSeason Index

The AltSeason Index is a tool that helps traders identify the optimal timing for investing in altcoins. It provides insights into when an “altcoin season” might be starting, which is a period when altcoins are expected to perform exceptionally well in comparison to Bitcoin. The index is likely based on various market indicators and historical data to predict these seasons.

AltSeason CoPilot

On the other hand, the AltSeason CoPilot is a more comprehensive tool that not only helps in identifying lucrative opportunities during the altcoin season but also offers guidance on profit-taking and exit zones.

It is designed for both portfolio managers and individual traders, providing data and insights to make objective decisions about the market’s rhythms.

The CoPilot is proven as a great tool for taking advantage of altcoin seasons and for trading ALT/BTC price spreads, indicating its utility in making strategic trades between altcoins and Bitcoin1456.

Key Differences

- Purpose and Functionality: The AltSeason Index primarily focuses on signaling the start of altcoin seasons, helping traders decide when to invest in altcoins. The AltSeason CoPilot, however, offers specific objective trend trading plan, including profit-taking and exit strategies, and is designed to assist in managing a crypto portfolio more effectively.

- Target Audience: While both tools are aimed at cryptocurrency traders, the CoPilot’s features suggest it might be particularly useful for those with a portfolio to manage or traders looking for more detailed guidance on trading strategies, including when to enter and exit trades.

- Scope of Use: The Index seems to be more about observing the market for altcoin season, whereas the CoPilot provides a more in-depth analysis, including risk management and diversification strategies, to position for altcoin season objectively. 48.

In summary, while both the AltSeason Index and the AltSeason CoPilot are valuable tools for cryptocurrency traders interested in altcoins, they cater to slightly different needs within the trading process, with the CoPilot offering a more detailed and strategic approach to trading and portfolio management.

- Investment Strategies on Reddit: Cryptocurrency enthusiasts on Reddit are sharing their favorite altcoins for 2024 and discussing investment strategies. Some users are focusing on altcoins with potential for significant returns, while others are considering diversifying their portfolios or cashing out before the expected highs281213.

- Twitter Crypto Discussions: On Twitter, users are listing their top three cryptocurrencies for April 2024, with Bitcoin Price Predictions being a hot topic as the ‘halving’ countdown begins. Bitget.com, KuCoin, and CoinDesk are among the accounts providing updates on the latest crypto news and trends.

It’s important to note that while there is a lot of optimism surrounding the potential for an altcoin season and the impact of the Bitcoin halving, the cryptocurrency market remains highly speculative and volatile.

As such, investors are advised to conduct thorough research and consider their risk tolerance before making investment decisions.

This post was created from the AltSeason CoPilot data using ChatGPT, Perplexity AI with Make.com automation.

Sign up for the AltSeason CoPilot. Each day we manually review each altcoin/btc chart and we update the trade status as we rebalance our model portfolio from day to day. The pie chart above is our Altseason Index.

Risk Disclaimer

You should not invest money that you cannot afford to lose. Seek advice from a certified independent financial adviser if you have any doubts.

Nothing in our training products are a promise or guarantee of earnings.

Please read our https://introtocryptos.ca/about/terms

Crypto Authors: Write for us

Connect on Twitter and Linkedin

Trade safe and keep those losses small.

Doug