‘Altcoin Season’ plays a pivotal role for investors in 2024. This is a timeframe in which altcoins generally tend to outperform Bitcoin.

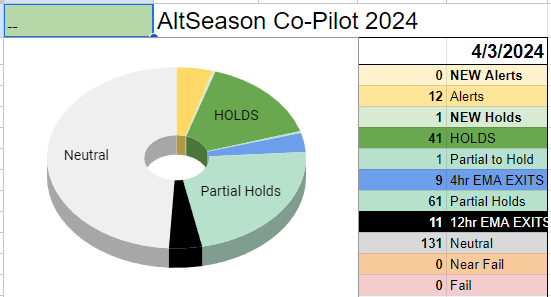

The AltSeason CoPilot report for 2024-04-03

2024 Altcoin Season with the AltSeason CoPilot

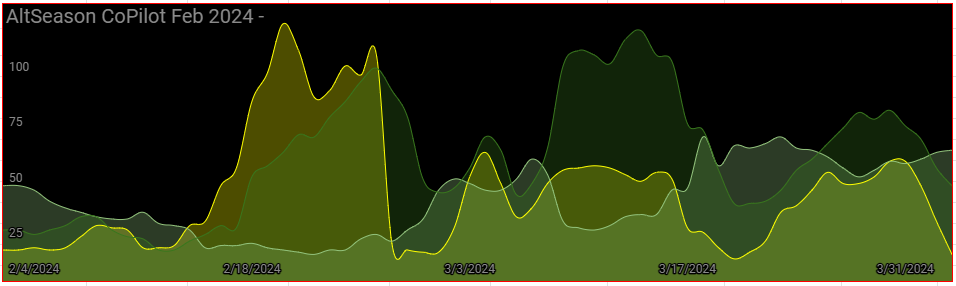

As portfolio managers and crypto enthusiasts we are watching the recent activity with Bitcoin’s dominance showing signs of fluctuation.

Today, the data emerging from the AltSeason CoPilot signifies a cautious tendency with our positions.

The data reports there are **zero New Alert status coins** today, which normally imply upcoming opportunities for entry.

And only **one New Hold status coin** and just **one moving to Partial Hold status**.

These instances signal that buy positions for these few altcoins remain favorable for review.

On the bearish side, our data about market conditions also indicate caution as there are **nine altcoins in Partial Exit status** and a larger number, **eleven coins, in Full Exit status**.

Below is a clear representation of the day’s market activity according to the AltSeason CoPilot’s data:

| New Alert | New Hold | Partial to Hold | Partial Exit | Full Exit |

|---|---|---|---|---|

| 0 | 1 | 1 | 9 | 11 |

Such signs could reflect profit-taking zones or reactions to overextended periods of growth, as well as potential bearish retracements.

Portfolio managers should approach the current landscape with strategic caution, focusing on coins that maintain a Hold status for potential growth while being ready to take action on those in a Partial or Full Exit status to capture profits and mitigate potential losses.

AltSeason Portfolio Strategy for April

In April of 2024 we are preparing for the potential that the market shows signs of selective bullish behavior, with opportunities lying in specific altcoins.

However, in the sort term the presence of a significant number of coins in exit status calls for attention to risk management.

The AltSeason CoPilot’s approach underscores the essence of trading safely by recognizing these conditions and implementing a disciplined strategy.

It is imperative to recognize the importance of risk control strategies and diversification.

Trading ALT/BTC spreads allows for taking strategic positions in multiple cryptocurrencies, capturing growth in the most promising coins while reducing exposure to underperformers.

Key Trading Tips To Remember

Keeping an eye on the AltSeason CoPilot data will enable crypto portfolio managers to be objective about the rhythms of the markets.

The following article was created based on our unique trading approach. Grab our 7 day trial. Join thousands and learn to profit from trend trading.

Frequently Asked Questions

This post was created from the AltSeason CoPilot data using ChatGPT, Perplexity AI with Make.com automation.

Sign up for the AltSeason CoPilot. Each day we manually review each altcoin/btc chart and we update the trade status as we rebalance our model portfolio from day to day. The pie chart above is our Altseason Index.

Risk Disclaimer

You should not invest money that you cannot afford to lose. Seek advice from a certified independent financial adviser if you have any doubts.

Nothing in our training products are a promise or guarantee of earnings.

Please read our https://introtocryptos.ca/about/terms

Crypto Authors: Write for us

Connect on Twitter and Linkedin

Trade safe and keep those losses small.

Doug