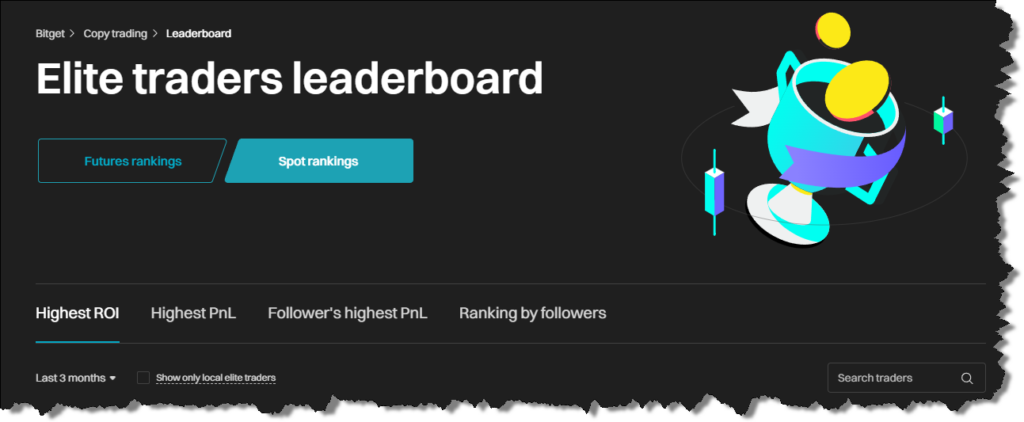

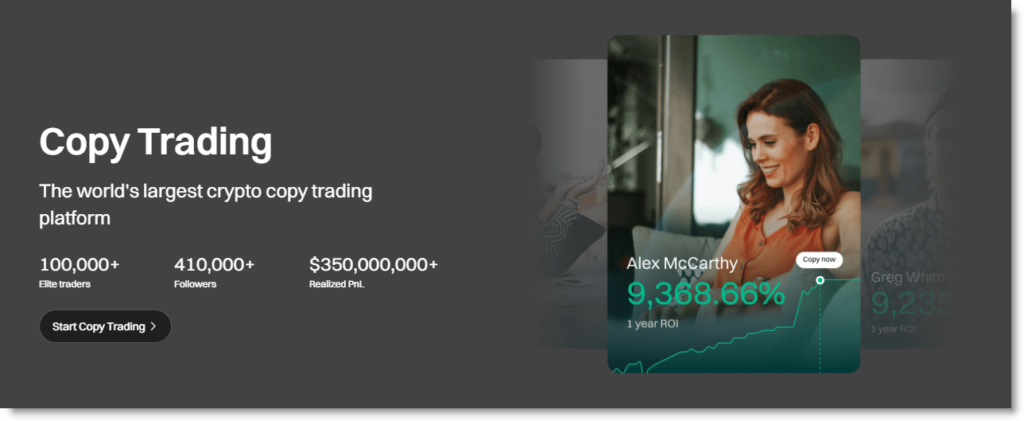

A simple and easy way to trade digital assets. Step-by-Step Guide to Crypto Copy Trading on Bitget. Elite Trader Leaderboard review.

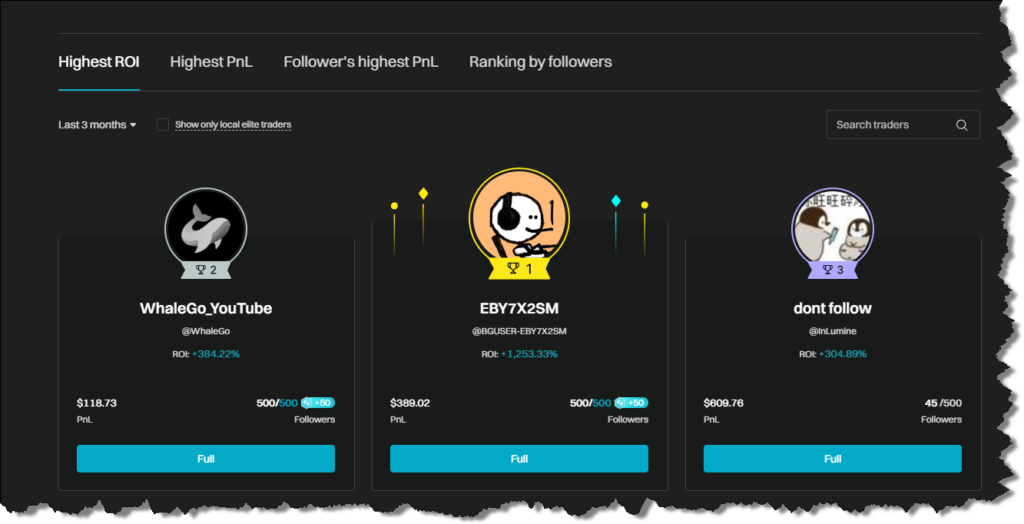

In this post I’m going to review some of the Elite Traders Leaderboard.

I’ll start with a focus on spot trading and I’m going to look for top performers in the past three months then I’ll drill down into specific profiles to find someone who is doing a good, diversified, trend-following strategy.

There are top performers who focus on trading one market with futures long and short – but I’m going to focus on something longer term and without the added risks of leverage trading.

This list will change all the time and I’ll be posting more reviews of the top copy trader profiles.

What Can We Learn About The Traders We Copy?

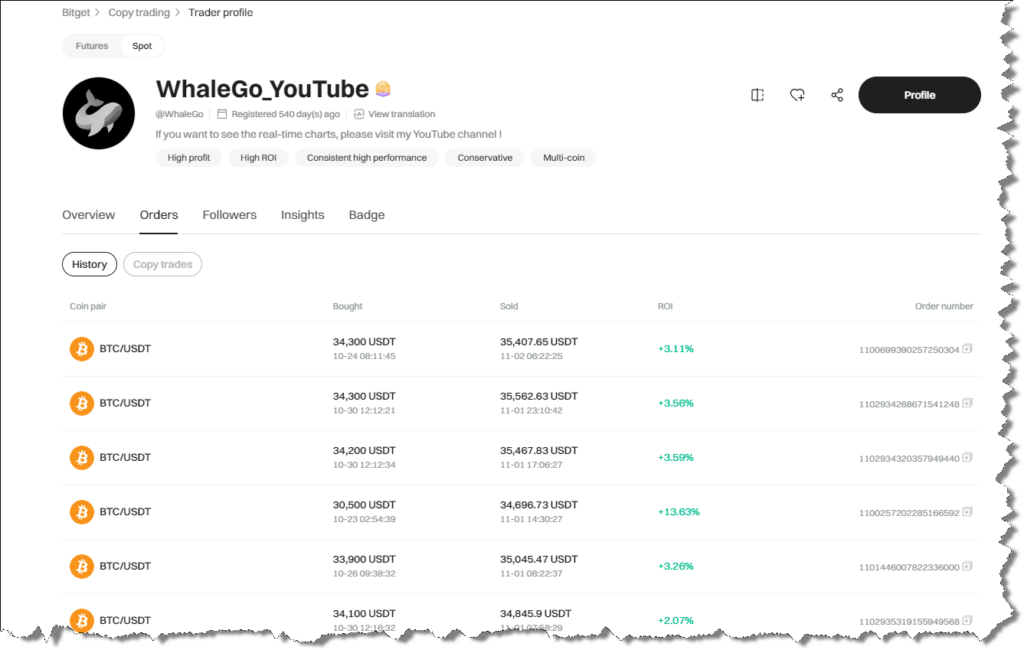

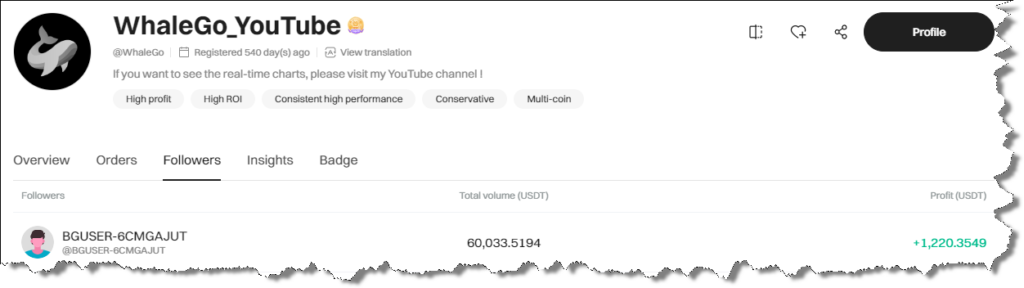

For example WhaleYouGo shows a great listing rank for spot trading.

Let’s take a closer look at the profile:

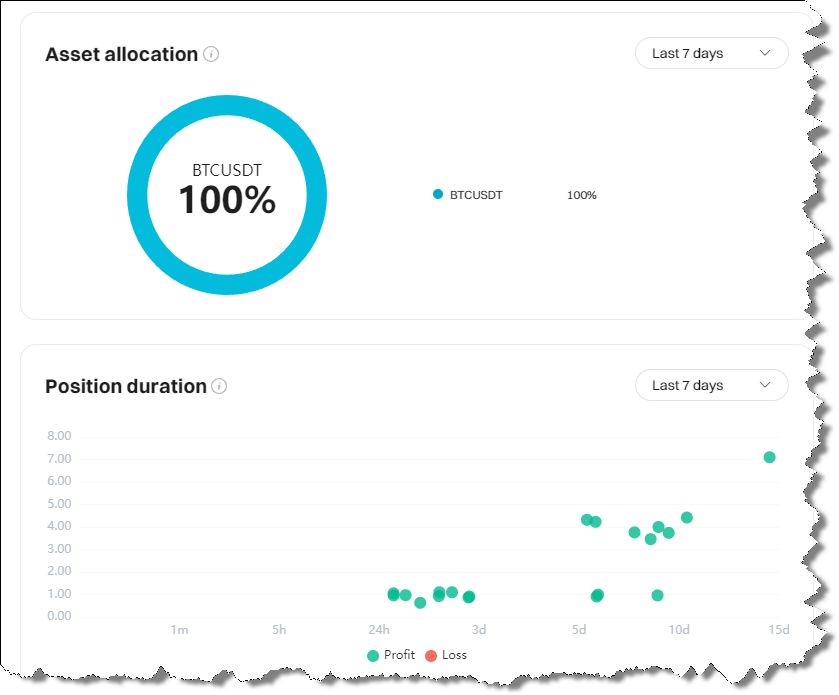

I’m seeking a diversified approach that trades each market very seldom, while WhaleGo_YouTube is taking many small positions and taking profits.

I can’t comment on the trading strategy but that it’s not what I’m seeking.

I have a personal preference for a strategy that is diversified when altcoin season is approaching. So there may be a phase when my positions are only held for a short time.

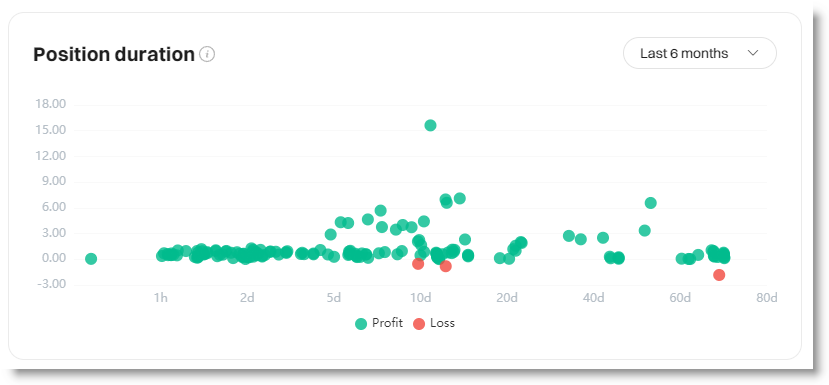

This screenshot would have demonstrated better data for me if I had looked at the 6 month view.

WhaleGo_YouTube 97% Win Rate

Well – the 6 month view shows a very consistent winning strategy – gaining small profits on the close… holding till the trade is just in profit?

I dunno – but some of the longest hold trades

COULD have been the biggest winners. No?

Can’t argue with the Win Rate?

Top follower traded 60k volume and made $1.2k

I’m pretty excited now I can really dig into the history of the copy trade accounts I’m reviewing.

Let me check a few more.

Hmm.

Profile after profile has the same quote ‘Earning money now, too busy to talk‘. And all of them are focused on trading one single coin and showing an algo-trading pattern to the profits.

For example:

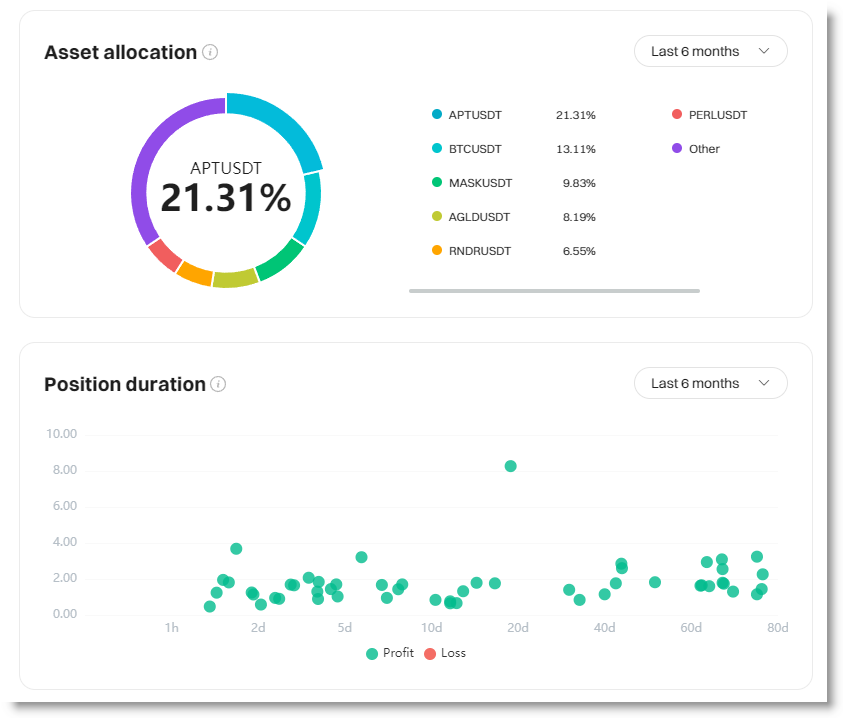

➤ ➤ AlgoTrader1337 has 50/300 followers and is trading BTC, APT, MASK, AGLD, RNDR and others. Nice actually. Diversified and great win ratio.

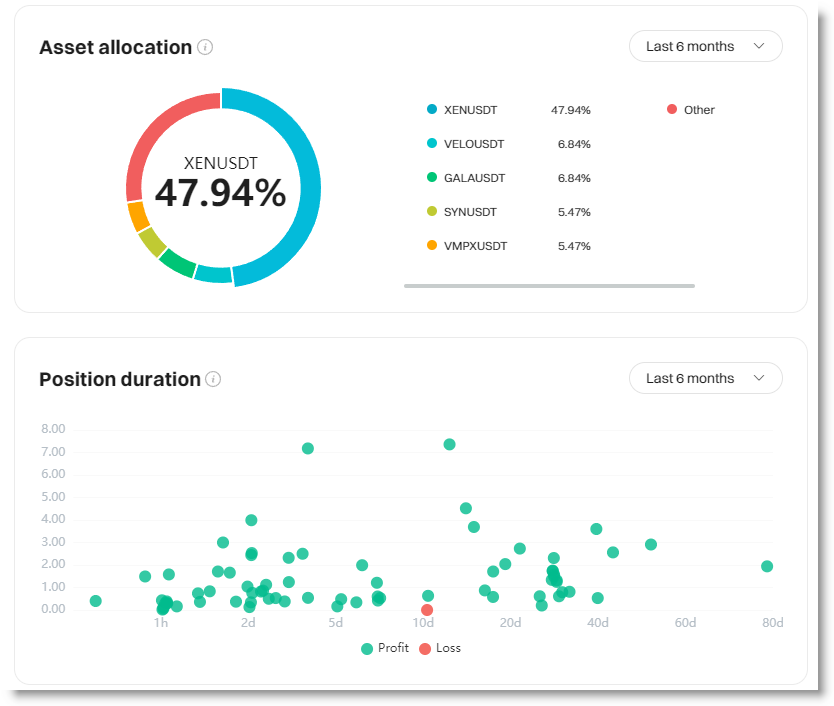

➤ ➤ CryptoTrader has 13 followers and trades a nice diversified range of coins and I also like to see the pattern of trade volume. This system is different than my approach but clearly profitable. I like it!

Setting Up Copy Trading

Get Started Here

As I’m poking around and getting familiar with the platform, I’m learning more detail about how the Copy Trading works:

- Checking Out the Top Players: Think of this like checking out the stats of the best players on a sports team. You get to see how long they’ve been playing (that’s the “Registration days”), how many fans they’ve got (“Followers”), and their score average (that’s the “Return on Investment” or ROI). Plus, you can see their wins and how often they win (“Profitable trades” and “Win rate”).

- Setting Up Your Game: Now you’re ready to play. You pick the top player you want to follow and decide how much money you’re going to play with. It’s a bit like choosing your gear before a big game. You can pick the easy setup (“Common settings”) or get into the nitty-gritty if you’re feeling brave (“Advanced settings”). And just like in a game, you’ve got to know when to stop – that’s your “Risk control.”

- Keeping Score: Once you’ve started, you can check out your dashboard to see how much money you’ve put in (“Invested principal”), what you’ve made (“Net profit”), and how your current trades are doing (“Current copy trades”).

- Changing Your Strategy: Say you’re in the middle of the game and you want to switch up your tactics. You can go back to your dashboard and make changes. But just like in a game, you can’t change moves you’ve already made; you can only change what you’ll do next.

- Cashing In or Bowing Out: Finally, when you’re ready to take your winnings or cut your losses, you go to the “Spot” page. It’s like going to the bank or leaving the casino – you’re either putting your money in your pocket or walking away to play another day.

It’s all about using the wisdom of the pros to make smarter moves in the crypto world. Just like in school or sports, it’s about learning from the best and using that knowledge to get ahead.

Spot Copy Trading

Unlock Effortless Trading with Bitget!

Want a simple and easy way to trade digital assets? Introducing Bitget Spot Copy Trade—an easier and faster way to get your copy trades filled at low slippage prices. Here’s how to get started in three simple steps.

Step-by-Step Guide to Copy Trading

After logging in, hover over the Copy Trading tab and select Spot Copy Trading. Choose a trader and select Follow.

Customize Your Trading Strategy

Click Edit to select your spot trading pairs. You may also choose Fixed or Multiplier modes. Set your fixed or leverage amounts and risk management parameters. You can even toggle the Advanced Mode to adjust the parameters for each spot trading pair you follow.

Finalize and Profit

Once done, tap Next. Confirm the parameters that you’ve selected for each trading pair and select Confirm. Congratulations, you’ve now successfully copied a trader. Ready to profit? Spot Copy Trade with Bitget today!

And that’s the gist of it. Check out the official docs to get more detailed mumbojumbo about Bitget Copy Trading.