JOE, LINA, OAX have rocketed out of the gate to Mark The Start of Altcoin Season 2023! In this post we review the before and after screenshots and point out some common factors about the price chart of these breakout crypto project.

At the end of the post, we’ll close with a brief list of cryptocurrencies that are also showing these EXACT same common factors!

JOE/BTC chart

The trade signal was published on March 20 after JOE/BTC consolidated following a strong breakout a few days prior. Waiting for a consolidation like this begins with knowing this chart pattern so you can recognize it before The Start of Altcoin Season – then the secret is to scan many markets and trade those that have this pattern… rather than waiting and anticipating for YOUR market to make this pattern.

Now, on April 6, the JOE/BTC trade has many different strategies for managing the stop loss. The AltSeason CoPilot will close the position according to this TradingView AltSeason Indicator, while the PRO ALERTS will leave the stop way back, just above the entry.

LINA/BTC Chart

The trade alert signal for the LINA/BTC trade example was published March 26. Price had demonstrated two strong prepump patterns followed by a steady selloff, and having returned to historical support levels, our system had a Risk to Reward ratio that was in our favor.

In the April 6 screenshot we can see our stop level is above our entry and risk is managed on this trade. So long as the open profit is over 51% gains, this trade will be featured in our live list of Best Coins For Altcoin Season 2023.

OAX/BTC Chart

On March 23, the OAX/BTC trade signal was published based on this long term pattern. OAX held higher lows vs BTC from September 2022, May of 2023 and now making a 1-2-3 bottom right at historical levels… This combination chart patterns didn’t give much warning before the surge – and now, something even more exciting is building up!

OAX/BTC price has pulled back and found a consolidation that is almost EXACTLY what our trading plan looks for – not as the start of altseason, but as our add on signal!

Should price break above our second buy signal, we can move the stop losses above our average entry price, and we have successfully increased our position size without increasing risk!

The AltSeason CoPilot trading plan has no provision for adding on, but instead, would be watching to exit the position because the 4 hour EMA’s have crossed bearish!!

Only our PRO ALERTS signals provide this approach – both in our model portfolio spreadsheets, and in our Automated 3commas Trading Bots.

List of New ALERT Cryptocurrencies

April 5

April 6

Overnight, a set of 29 ALT/BTC pairs have crossed our thresholds from Neutral status into ALERT status.

AltSeason CoPilot is suggesting that we should be completing the work of Stage 1 of the trade on those 29 trading pairs! The Daily Action Matrix makes it simple and easy to double check your trades.

Learn all 5 Stages Of The Trade in our Free Crypto Trading Plan PDF. See how.

It’s good to plot the number of ALERT status coins over time so we can see when they have been growing or declining over time. This graph below provides an important perspective on the importance of this shift in Altcoin Season 2023!

We plotted the number of ALERTS, and we can see how they were slowly the past week or so, but overnight we have a large group of coins that have completed 2 of 3 of the requirements for the AltSeason CoPilot to flash a buy signal!

The Start of AltcoinSeason 2023

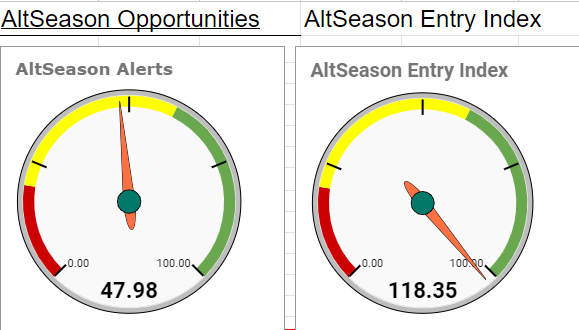

The ALTSEASON Opportunities meter jumped higher, and the ALTSEASON Entry Index remains maxed out!!

This is the PRIME window of opportunity that we have been waiting and preparing for to mark The Start of Altcoin Season 2023!

Learn more about The 5 Stages Of The Trade in the Free Crypto Trading Plan PDF.

Don’t let ANOTHER altcoin season pass you by without a clear plan to practice!