Build a crypto portfolio at the right time you can make huge gains from each AltSeason. After plotting out every Altcoin Season over the past four years, our team came up with a list of things to consider when building out a diversified crypto portfolio in a trend following trading plan.

Your Big Picture Plan

Asset allocation: Use a percentage approach to diversify your total assets into different investment pools, cash savings, precious metals, revenue generating assets, stocks and an investment pool into crypto. Crypto is amazing, crypto is great… AND we also need a broad financial plan.

Your investment pool in crypto may only represent 20% of your overall wealth. And the crypto investment strategy should include a trading plan based on price change and a distribution plan to diversify crypto profits to assure your personal long term wealth and financial security.

If you are 100% focused on crypto, start making a plan to invest your profits into a small revenue generating asset. For example, purchase a hardware computer as a passive income generating strategy like providing computing power or cloud storage…

Your Best Crypto Portfolio

Risk management is our job as traders. As we plan to build the list of best cryptocurrencies to hold in 2023, we’ll start out with small position sizes across many different coins.

Getting Set Up

Here are a few points to check off as you prepare to build your next crypto portfolio:

- Position sizing: Consider smaller position sizes across more markets. Less than 2% of your crypto investment pool into any one coin or token.

- Risk management: Consider your stop loss order as the ‘insurance fee’ you are willing to pay to have your money watch that price chart. Our job is to limit potential losses and protect capital.

- Market selection: Selecting markets that pass our AltSeason TradingView Indicator are likely to continue to trend and increase the chances of holding the best performing coins in 2023.

- Diversify across blockchains: research the top dApp projects on each Layer1 Protocol to help improve exposure to industry disrupting technologies.

- Time horizon: Take time off the table when building a diversified portfolio and simply follow the ebb and flow of altcoin season.

Your Crypto Profits

Altcoin Seasons come and go. After every altcoin season is finished and we’ve closed most of our trades, it’s time to move those profits. Crypto seasons come and go once or twice each year and we can begin to plan that assumption into our long term financial plan of becoming a crypto millionaire.

- Tax implications: Tax implications of a trend following portfolio are more likely to fall under long-term capital gains. Be informed. We recommend CoinTracking as a tool that every crypto trader should use to generate sample tax reports.

- Rebalancing: Only rebalance your crypto portfolio as more markets are passing our Altcoin Season entry or exit signals to optimize returns over time. The Crypto SmartWatch Daily Action Matrix can save you hours of chart scanning every week!

- Monitoring: Regularly monitor the performance of the crypto portfolio. Send profits off exchange. Be sure to own a cold storage hardware wallet and we recommend keeping that hardware wallet in a safety deposit box in a bank vault.

Leverage Not Required

Avoid the use of leverage: Careful consideration should be given to the use of leverage, as it can magnify both gains and losses. The random volatile nature of crypto is enough to ruin good trades – even if you are right – when leverage is added to crypto trading.

When To Get In

To understand altcoin season, it’s important to understand how Bitcoin Dominance and Altcoin Season are related and what other tools may give a more clear picture.

Watch the progression of Altcoin Season

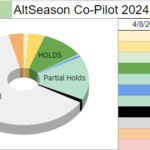

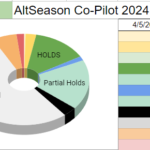

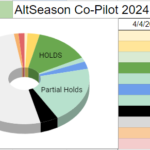

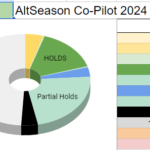

The following sequence of pie charts show the approach of the January 2023 mini bull market in altcoin prices. The surge of price bullishness can be observed as the number of ALERT status coins increased day by day.

When To Get Out

Your exit signal is the most overlooked part of the trading plan for new traders. Pro Traders know that managing risk is our only job, and must know all your exit signals as a reflexive, memorized habit.

The Crypto SmartWatch control panel and daily action matrix make it easy to stay in tune with altcoin season as it passes.

Let go of those coins (yes, even let go of those amazing projects) that drop below the exit criteria. Let go of them with confidence… because our trend following system will pick them up again later.

AltSeason Waves

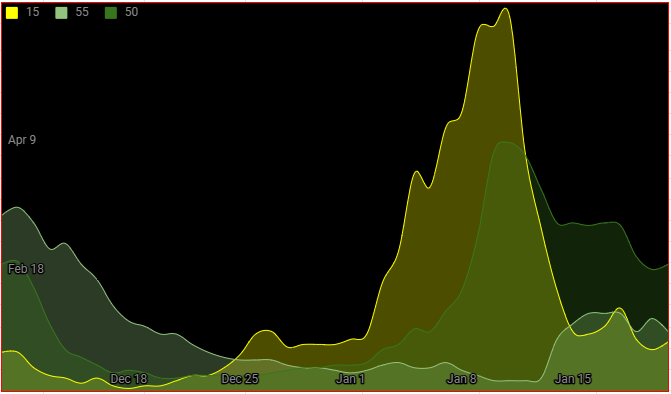

The Pie Charts above can also be plotted over time to give us a deeper understanding of the Altcoin Season momentum.

The Crypto SmartWatch is an objective crypto portfolio tool that can help us focus our attention onto the segment of the 100’s of Altcoins to find those projects that have best investor interest and perhaps build a crypto portfolio full of the best cryptocurrencies to hold for 2023.

Build a crypto portfolio at the right time you can make huge gains from each AltSeason. After plotting out every Altcoin Season over the past four years, our team came up with a list of things to consider when building out a diversified crypto portfolio in a trend following trading plan.