Cryptocurrency trading has already been overtaken by Trading Bots. And with the shear numbers of new cryptos, many successful trading firms have begun offering auto trading bot services so others can follow along and copy their trading strategies.

A crypto auto trading bot is simply a program that automatically executes trades on behalf of a trader based on predetermined trading strategies.

In this article, we will explore the benefits of using a crypto copy trading bot, how they work, and some of the best bots available in the market.

Benefits of Our Crypto Auto Trading Bot

- Diversification: Our crypto auto trading bot will manage the work of monitoring risk and profits on hundreds of small positions.

- Consistency: The bot follows the proven trading strategy consistently, removing the emotional aspect of trading that can lead humans to make impulsive decisions.

- Chart Freedom: A crypto auto trading bot allows traders to stop watching the charts and do other things! You no longer need to monitor the markets – and you can focus on family, creativity and community.

How Do Our Trading Bots Work?

Our crypto auto trading bot works by signaling 3commas, which executes trades in our Binance account based on our objective trading strategy.

The bot receives it’s signals from our PRO ALERTS trading spreadsheet which covers almost 300 different ALT/BTC trading pairs on Binance.

Our portfolio balancing spreadsheet is managed by our team of full time crypto traders who are always available on our Discord Community to discuss any one of the trade signals.

Best Crypto Auto Trading Bots

https://3commas.io/?c=dealcode

- 3Commas: 3Commas allows traders to automate their trades across multiple exchanges. The platform has a user-friendly interface that makes it easy to follow the CryptoBalancingBot.

- CryptoHopper: CryptoHopper is a trading bot platform that can be programmed to trade on a range of cryptocurrencies across multiple exchanges.

- BitGetCopyTrader: BitGet is a popular trading platform that allows users to copy trade the proven trading strategies of other members. BitGet copy trading provides a range of trading approaches to fit your individual trading preference and risk tolerance.

Consider This Before Using any Bot

- Security: It is important to ensure that the bot you are using is secure and has a good reputation in the market.

- Flat Fees You Can Understand: Most trading bots charge a fee for their services. It is important to understand the fees involved before using a bot.

- Ease of Use: While some bot platforms, like 3commas, are user-friendly, others require a certain level of technical knowledge or even coding knowledge in order to use them effectively.

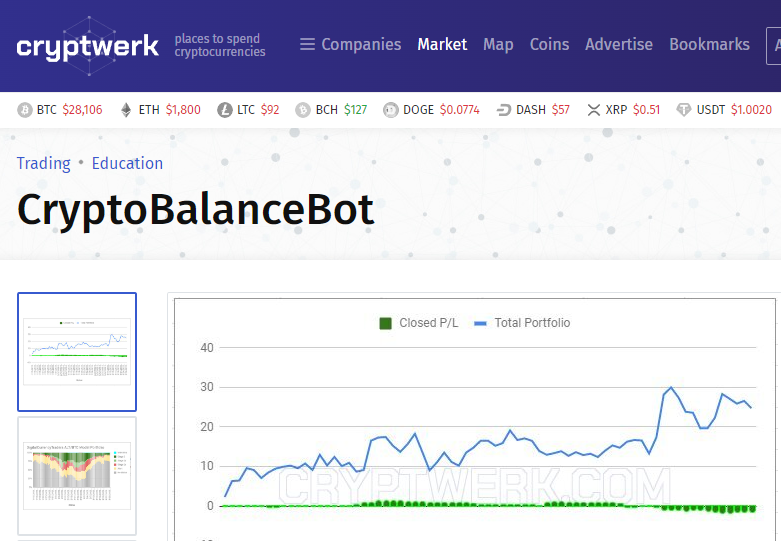

- Backtesting: look for a bot that has a proven track record for trading altcoin seasons with a diversified portfolio.

Risks of Using a Trading Bot

- Technical glitches: Like any software, trading bots can experience technical glitches that can lead to losses.

- Market volatility: Crypto markets are highly volatile, and sudden market changes may cause losses.

- Second-guessing the bot: It is important to understand the price ranges that your trading plan is tuned to capture – so you can stop making common trading errors and leave the bot to trade and monitor the markets while you do other things!

FAQs

- Are crypto auto trading bots legal?

Yes, crypto auto trading bots are legal. However, it is important to ensure that the bot you are using does not have counter-party risks. It is also important for you to ensure the bot is compliant with any regulations in your jurisdiction regarding cryptocurrency trading. - Can a trading bot guarantee profits?

No, a trading bot cannot guarantee profits. The bot can only execute trades based on predetermined trading strategies. It is important to remember that there is always a risk of losing money when trading. Traders should understand how the bot’s trading plan manages risk and how it plans to diversify the portfolio before copy trading any bot profile. - Do I need technical knowledge to use a trading bot?

Some trading bots are user-friendly, while others require a certain level of technical knowledge to use effectively. For example, some bots may require users to have knowledge of programming languages like Python or JavaScript to create and customize trading strategies. However, following our bots on 3commas is easy with their user-friendly interface and requires little to no technical knowledge to use. - Can I use a trading bot across multiple exchanges?

Yes, many trading bots support multiple exchanges. While the CryptoBalanceBot is currently providing signals for Binance exchange, we can send signals to any of the exchanges supported by 3commas. Contact support for help. - How do I choose a trading bot?

Choosing a trading bot can be intimidating. There are many options available and many of them are mysterious. Traders should research as much as possible and read reviews from other users before choosing which bots to use.