Are you a cryptocurrency Trader? I’m going to share the three places where you should be keeping your money for Perpetual growth.

When To Hold Altcoin, Bitcoin or Cash.

The Ultimate Crypto Investing Triad.

I’m going to outline the details of what I see shaping up for crypto right now and I’m going to give you a specific plan so that you know exactly what to do without any news, without anyone telling you when the signals fire,

but before I get into that today,

I was just curious and I wanted to know…

ツ how long have you been watching my channel on YouTube?

ツ …and what are some of the things you find in my videos that are different than other channels?

► √ I’d like you to take a second and leave a comment down below and let me know what’s the most valuable thing that you’re getting here,

► √ let me know what kind of trading approach you focus on and what kind of results have you been getting for the past couple years.

I want to make videos that help you make money and not just waste your time with an opinion.

So let’s jump into the triangle.

The first question that triangle solves is:

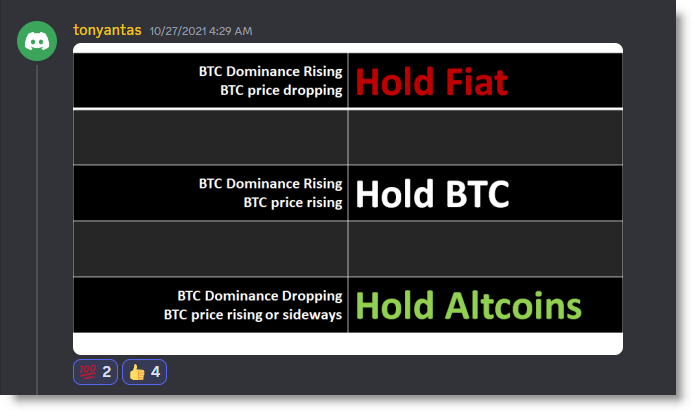

should we be holding Bitcoin

or should we be holding cash?

When To Turn Cash Into Bitcoin

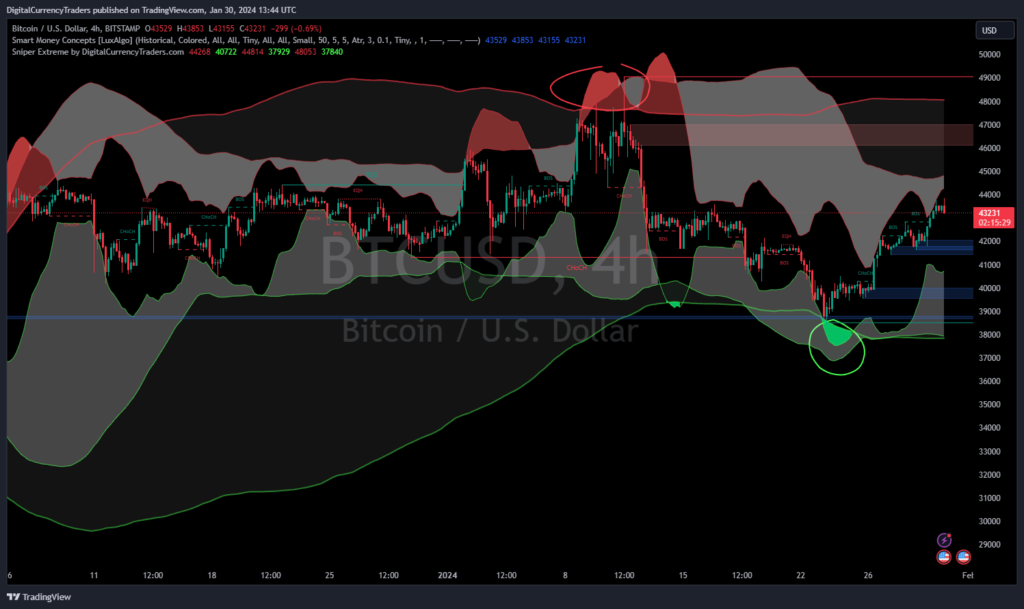

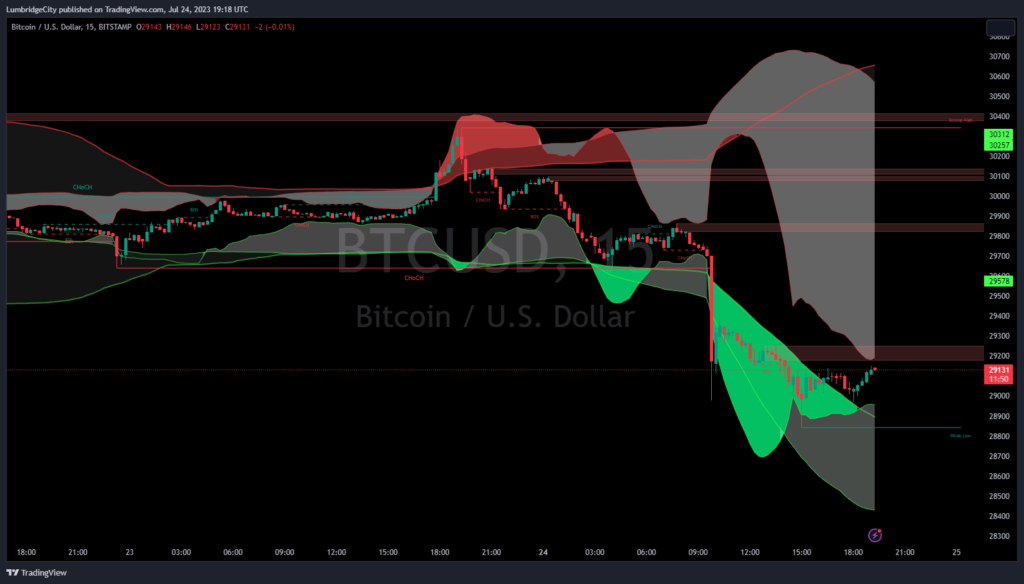

Our system solves that with the 123 formation, the break of the trend line and the EMA cross, and our latest signal was to buy Bitcoin on January 25th or so when we noticed that a similar signal was shaping up to what we saw in August.

Then the second question that our triangle solves is when should we be holding altcoins?

So most of the time we should be holding Bitcoin and sometimes we should be holding altcoin.

80 Percent Bitcoin

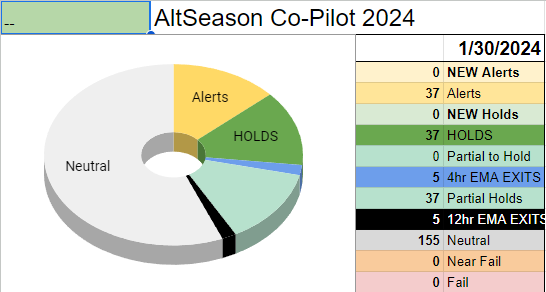

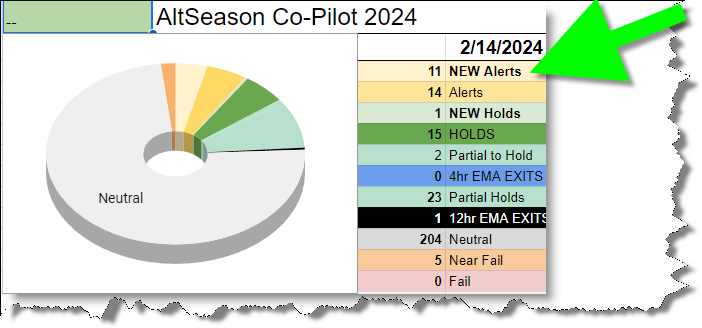

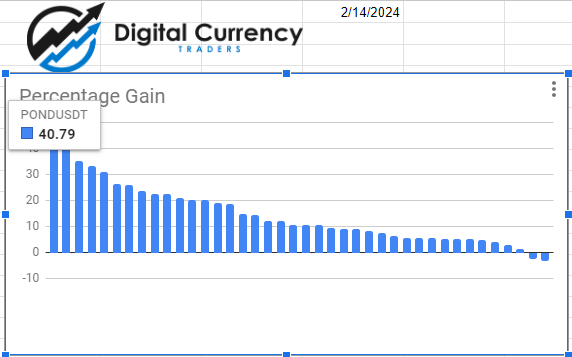

When we look at the alt season coal pilot spreadsheet from January 25th, we can see that our system had us holding 80% Bitcoin and 20% altcoins at that time.

Bitcoin has taken off, it’s been fantastic!

…but now something has changed.

Today on February 14th,

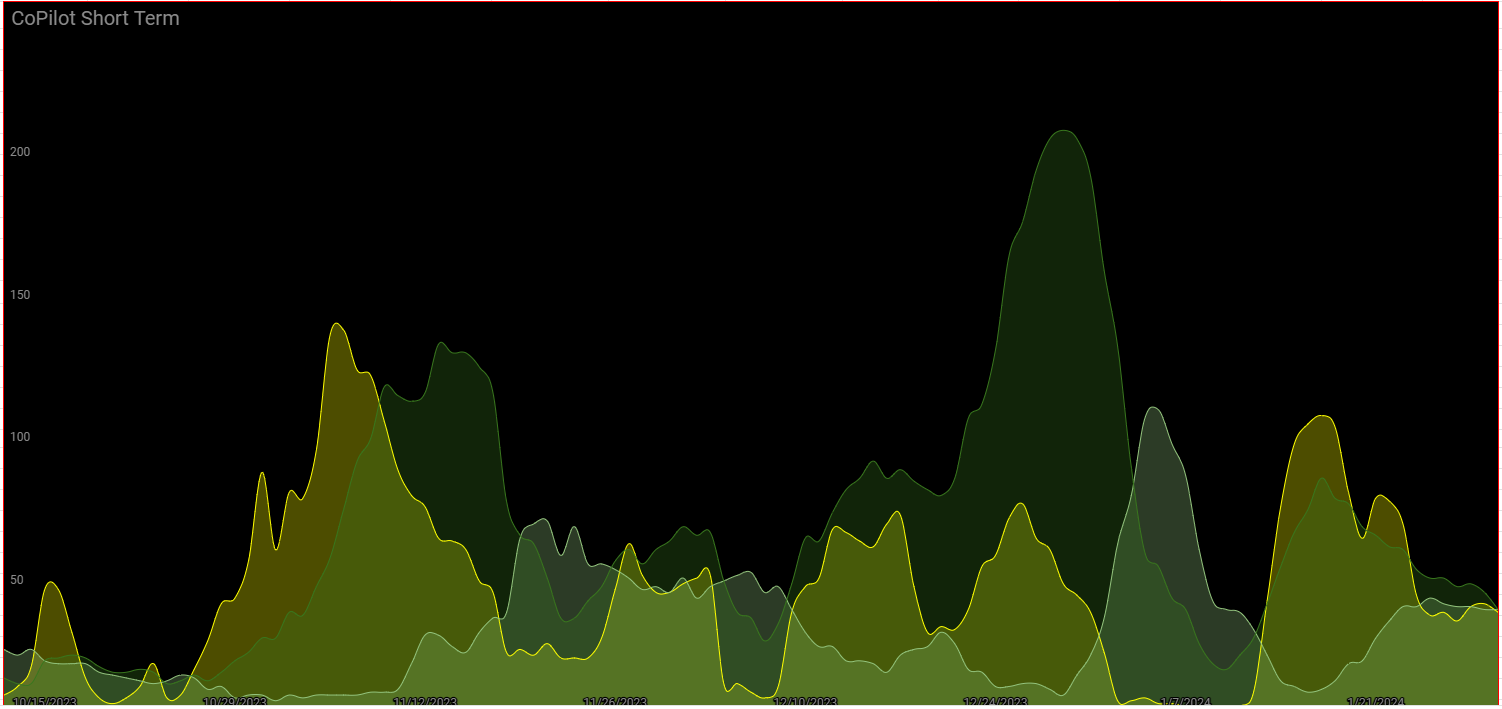

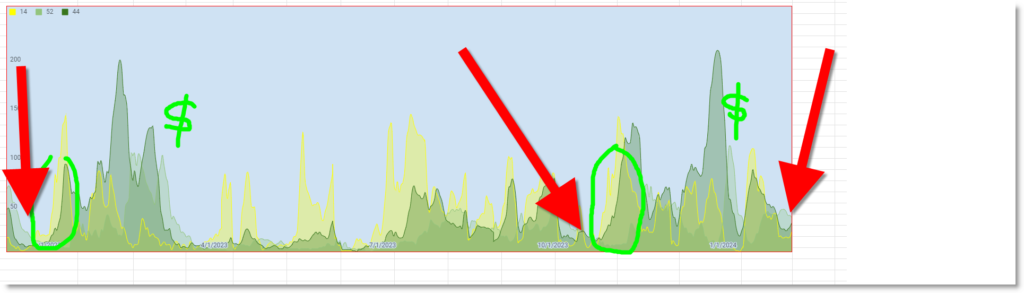

we see a new wave of coins passing the alert status.

This is occurring at the same time that Bitcoin dominance is showing a strong Divergence from bitcoin price.

Our historical data reveals that a surge in alert status coins is a powerful indicator of the onset of alt season.

In other words,

our system is suggesting that we should be now turning our Bitcoin into small bits of an array of different cryptocurrencies and then we should prepare to manage our risk.

Getting Deployed Into Crypto At The Right Time

You know this is always this part of altcoin season that I really get excited about, everything all setting up, I see these formations building up and I’ll post like crazy in our Discord.

The Only Way For Me To Know…

I’ve always wondered what is holding someone back from changing the way they trade so that it’s easier and takes a lot less time throughout the day.

So recently with a bit of consulting… and some guidance…

I’ve changed our membership so that;

➞ we have a 7-Day free trial so that you can get access to the Altseason Co-Pilot and all the training that goes along with it.

➞ and, you also can book a 30 minute one-on-one call with me.

So if you’re interested,

I can find out more about what you do for your trading approach and what kind of results you’ve been getting compared to the results that you’re really after.

Then I can give you a personal 5-minute tour of how our approach actually works.

And then if it feels like something that you’re looking for, you can just keep your membership going, if not you can cancel it and no harm no foul, off we go.

No matter which way these one-on-one calls go, I always get something great out of those calls and meeting somebody.

So if you’ve been trading for the last couple years and you’re not getting the results that you’ve been wanting, check it out, sign up for the free trial, book the 30-minute call with me and if it doesn’t work out, hey you’ll learn something, I’ll learn something and off we go to the next video.

Trade safe and keep those losses small.