It’s crucial to have a trading plan to objectively identify the altcoin opportunities to watch in 2023. You must know what to do during different market conditions. Let’s detail how to stay prepared to diversify your portfolio at the right time. How to preserve your capital in bear markets and also preserve the time you need to commit to trading.

An Uncertain World in 2023

As a cryptocurrency investor, you must always be prepared to face the ups and downs of the market. While the recent failure of collapse of Silicon Valley Bank in March and First Republic Bank in April and threats to the US dollar as the global currency bring uncertainty, you must have a trading plan that will stay out of bear markets and help you stay ready for when the altcoin opportunities present themselves.

Ten Altcoin Opportunities to Watch. Compare price charts against our proven trading plan, prepare the next altcoin season!

Altcoin Opportunities In The Big Trends

One key indicator that traders use to determine altcoin opportunities in changing market trends – is Bitcoin Dominance. Bitcoin Dominance is a measure of the total market capitalization of Bitcoin compared to the total market capitalization of all other cryptocurrencies. When Bitcoin Dominance is rising and Bitcoin prices are flat or falling, it’s essential to hold fiat currency to avoid any potential losses. This is because the market is likely in a bearish state, and it’s not the time to make any significant investments.

On the other hand, when Bitcoin Dominance is rising, and Bitcoin prices are also rising, it’s wise to hold Bitcoin. This is because Bitcoin is the most dominant and stable cryptocurrency, and when its price is increasing, it’s a sign of a bullish market. Holding Bitcoin during this time can help you capitalize on the upward trend and potentially increase your profits.

When Bitcoin Dominance is dropping, and Bitcoin prices are rising or remaining stable, it’s time to hold a select group of Altcoins. Altcoins are any cryptocurrency that is not Bitcoin, and they tend to have more volatility in their prices. When Bitcoin prices are stable or rising, and Altcoin prices are increasing, it’s an indication that the market is bullish towards Altcoins. We seek to hold Altcoins as they pass our trading signals during this time. Those that successfully pass our risk control rules may allow us capitalize on the upward trend and potentially increase profits.

Daily Habits To Spot Altcoin Opportunities

Our experienced AltSeason CoPilots understand the importance of having a solid trading plan. We follow a daily routine that involves analyzing 300 ALT/BTC pairs, comparing potential altcoins against the 5 Stages Of The Trade, and implementing risk management strategies to rebalance our diversified portfolio.

We believe that with the right approach, anyone can become a successful altcoin trader.

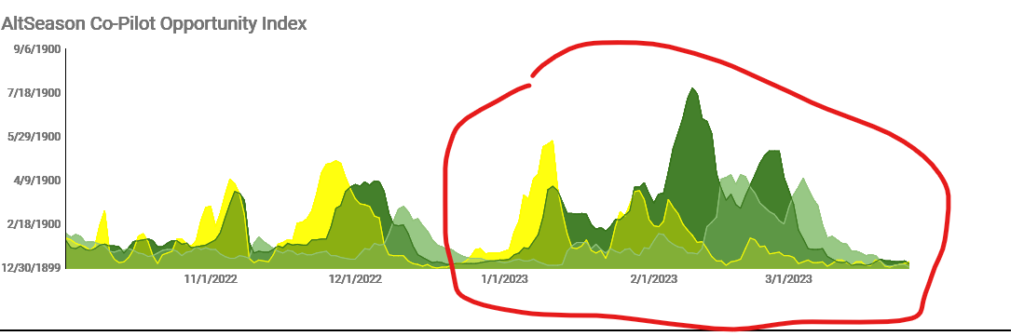

Altcoin Opportunity Index March 26

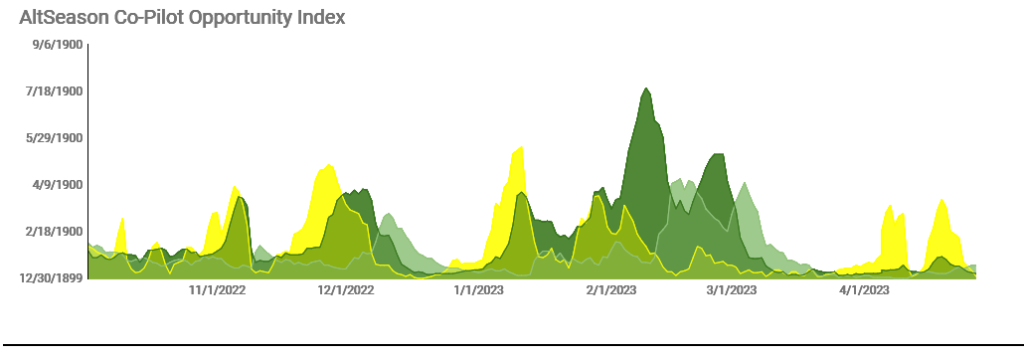

Altcoin Opportunity Index April 27

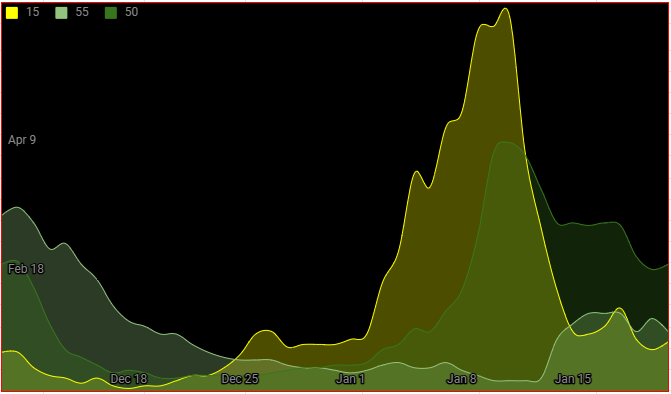

We can see the two charts above show that many ALT/BTC price charts moved into ALERT status through March. But most coins fell back into Neutral. Now we are in a phase of preparation for the next potential altseason wave in 2023 – when ever it should arrive.

An Excerpt From Our Data

Based on the current portfolio status data in the AltSeason CoPilot Spreadsheet, here are 10 altcoin opportunities to watch for in 2023: Some of the chart patterns are in ALERT status while others are in PARTIAL HOLD STATUS. Be sure to download our free Trading Plan PDF to review these price charts.

We are actively monitoring for EXITS to Stage 5 Of The Trade for risk management while being open to potential for this select group of coins to hold their levels.

Past Altcoin Seasons have started quickly, so we remain on sharp attention for any coins that are building a new 1-2-3 bottom.

- Elrond (EGLD) – A high-throughput blockchain platform with low fees and fast transaction speeds.

- TRON (TRX) – A blockchain platform for decentralized apps and smart contracts.

- Manchester City Coin (CITY) – A cryptocurrency launched by Manchester City Football Club.

- Cartesi (CTSI) – A layer-2 infrastructure that allows for complex computations off-chain.

- IDEX (IDEX) – A decentralized exchange with a focus on security and user experience.

- Komodo (KMD) – A blockchain platform with built-in privacy features and cross-chain interoperability.

- Origin Protocol (OG) – A decentralized marketplace for peer-to-peer commerce.

- Render Token (RNDR) – A utility token for a decentralized cloud computing network.

- Injective Protocol (INJ) – A decentralized derivatives exchange with no gas fees.

- Trader Joe (JOE) – A yield farming platform with innovative features and low fees.

By researching these altcoins and comparing the price charts against our proven trading plan, you can also prepare to take advantage of the next altcoin season!

But remember, we must plan exactly how we will manage risk and preserve capital BEFORE we enter our trade. Check out our Crypto Trading Plan Example PDF and our special Reducing Risk In Crypto Investments article for more tips on risk management.

To stay up to date with the latest altcoin trends and analytics, I recommend checking out Cryptocurrency Analytics and Crypto Trade Tracking. And if you’re interested in technical analysis, be sure to read this Ten Cryptocurrencies Pass our Technical ALERT signals article.

Remember, becoming a successful altcoin trader takes time and effort. But with the right mindset and daily habits, you can achieve your goals. As The AltSeason CoPilot, I trade the ALT/BTC spread with a simple daily routine that can help anyone achieve more success with their Cryptocurrency Portfolio Management in 2023. Good luck on your trading journey!