Hey there, fellow traders! It’s Doug, and today I’ve got a real treat for you.

We’re diving deep into a little known trading bot platform that promises to simplify our crypto trading game. You know how we roll in the Great White North: we dig deep and never skate on thin ice, eh?

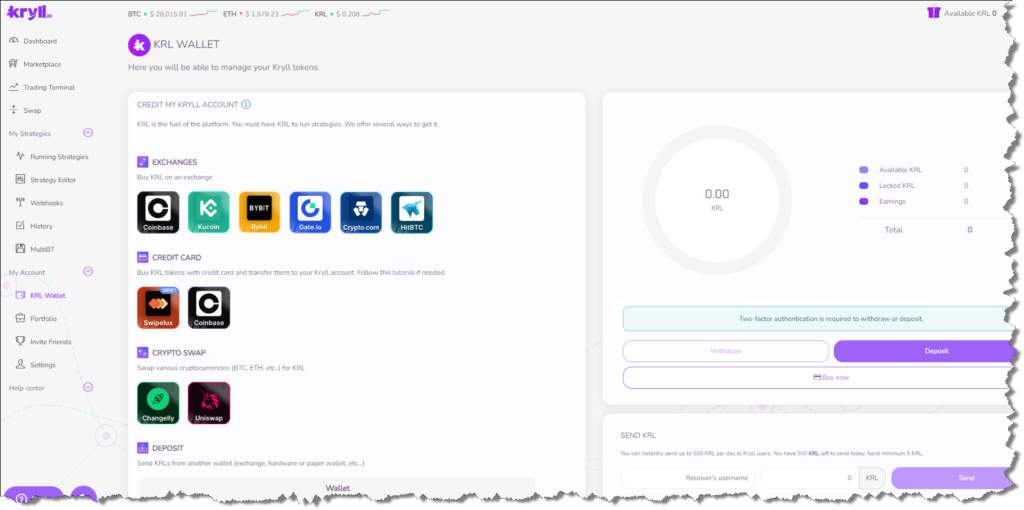

So let’s check out the features and a bonus code as well.

From their page on LinkedIn:

Kryll platform provides you with powerful tools to create your own crypto-trading strategies in an easy and intuitive way thanks to its “WYSIWYT” (What you see is what you trade) concept.

Trading Strategy Marketplace

First off, you don’t need to be a crypto wizard to make things work here. Kryll.io is designed to serve both the greenhorns and the grizzled veterans of the trading world.

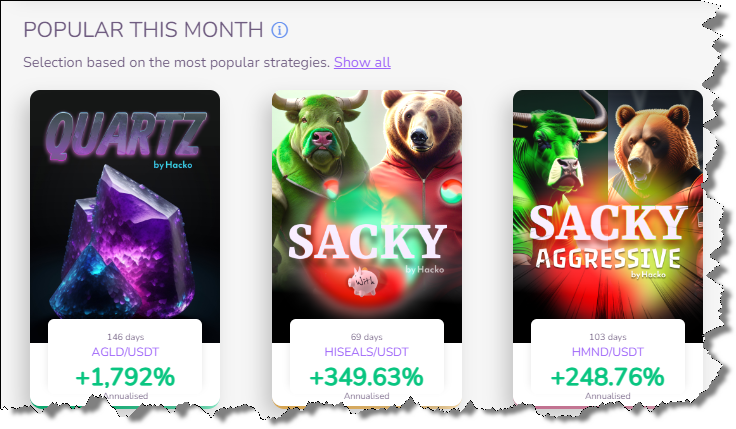

The platform offers a Marketplace where you can rent tried-and-true trading strategies from folks who’ve been around the block.

Seriously, how wicked is that?

Choosing the right platform is like choosing the right hockey stick. You need it to be reliable, sturdy, and a perfect fit for your game.

And let’s be honest, who wouldn’t appreciate a user-friendly interface so good you can trade while the kids are at hockey practice, eh?

Claim Your $7 In Tokens

Start for free, fill out the survey to earn free tokens and share your referral code to earn passive income over time! It’s a pretty sweet way to spend some free time and make some free money.

Play Safe, Trade Safe

Now, any good trader knows that juggling multiple exchanges is like playing goalie without a mask; you’re just asking for trouble.

Now we can streamlines this process and manage our crypto portfolio on one, single platform.

The platform’s got state-of-the-art security features, much like a well-guarded net. You can connect to your exchanges safely, keep tabs on your wallets, and breathe easy knowing your assets are protected.

Build Your Bot Army

Listen, I get it. Coding can be as daunting as a moose in the middle of the highway. But with Kryll.io, you don’t even have to touch a line of code.

You can build complex trading bots using their Drag’n Drop “WYSIWYT” (What you see is what you trade) interface.

It comes loaded with advanced trading indicators like MACD, RSI, Moving Averages—you name it.

What’s the real kicker here?

The fact that you can start small

and set realistic expectations.

Just like learning to skate, you don’t want to rush into things and end up flat on your face.

Take your time to understand what automatic trading really means.

Dive into strategy behavior, manage that risk like a pro, and learn from both your triple-deke goals and your penalty box mistakes.

What You See is What You Trade

You want to buy low and sell high, but setting up complex triggers feels like untangling a fishnet, doesn’t it?

The visual trading terminal helps you manage your stop-losses, take-profits, and even trailing stops. And all of this in less time than it takes to ask about the weather, again.

Trading from Your Igloo

Alright, we’re not all living in igloos, but you get my point.

With Kryll’s mobile app available on iOS and Android, you can manage your trades whether you’re chilling at home or out snowshoeing. All you need is a few taps, and you’re in control.

Tying It All Together

At the end of the day, what’s the one thing we can’t compromise on? You guessed it—risk management.

It’s the backbone of trading, folks.

Kryll.io helps you implement the risk control strategies that you learn in our Free Crypto Trading Plan PDF. Whether you’re into safe slapshots or risky breakaways, there’s something here for everyone.

Just like in the game of hockey, discipline, patience, and continuous learning are key. Keep your stick on the ice and keep hustling.

Can You Make Money From Nothing?

As Jessie Livermore once said, “The stock market is filled with individuals who know the price of everything, but the value of nothing.“

If you have nothing to do… make that free time into an asset.

A little idea can grow into a lot of money!

Give Kryll.io a shot and let’s turn those crypto dreams into cold, hard loonies.

Keep your gloves on and happy trading, eh! 🍁

This human-directed content research, writing, and editing was assisted by Artificial Intelligence Tools like Midjourney, Opus, Writesonic, and ChatGPT. (follow my AI publication for Business Plans)

Investment Disclaimer: You should not invest money into a paid tool until you have maximized the benefits of the free features.

Nothing in our training products is a promise or guarantee of earnings.

This article contains referral links for some of my absolute favorite AI business tools for content creators and crypto enthusiasts.

If you purchase one of my favorite software and AI tools, I will receive a small commission at no additional charge to you.