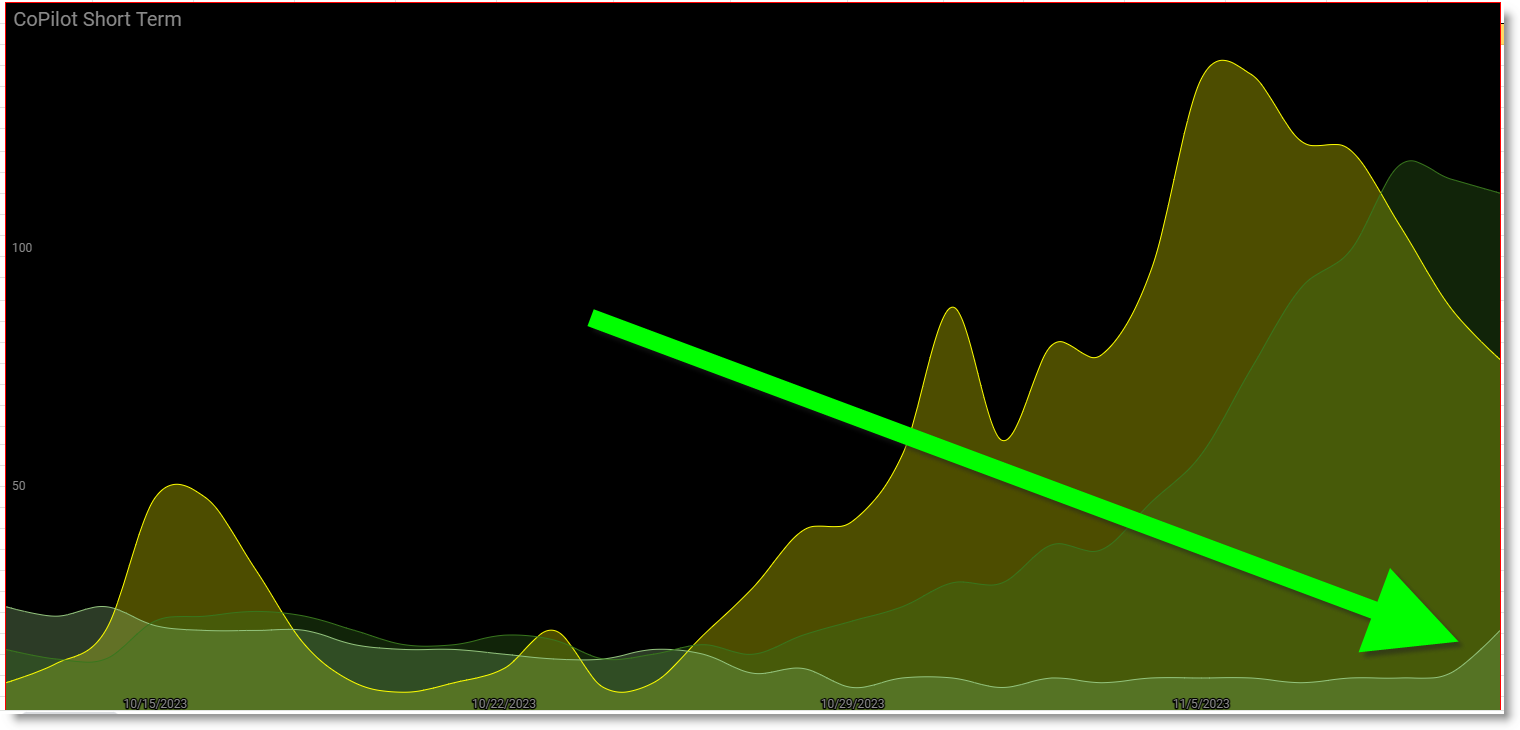

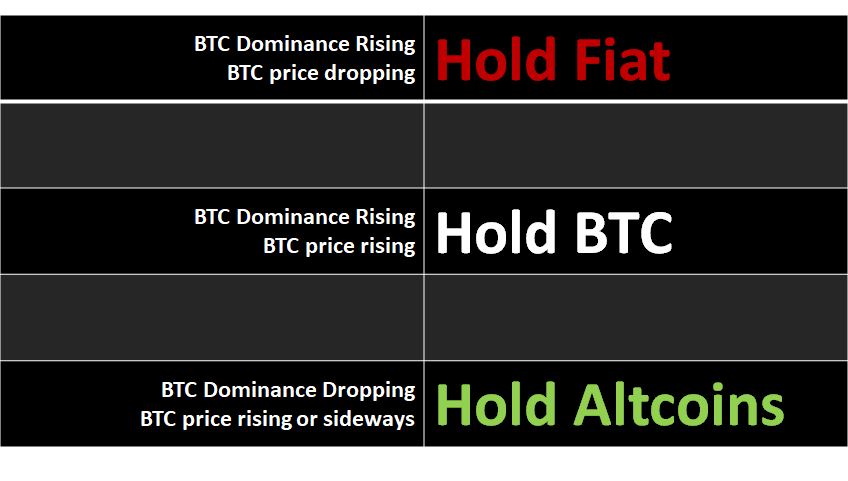

Three pools of money that portfolio managers constantly rebalance to match the cryptocurrency price trends.

It’s a pretty simple formula.

Yet human nature makes us second guess while we make transitions from one phase of our money holdings into the next phase as the trends ebb and flow.

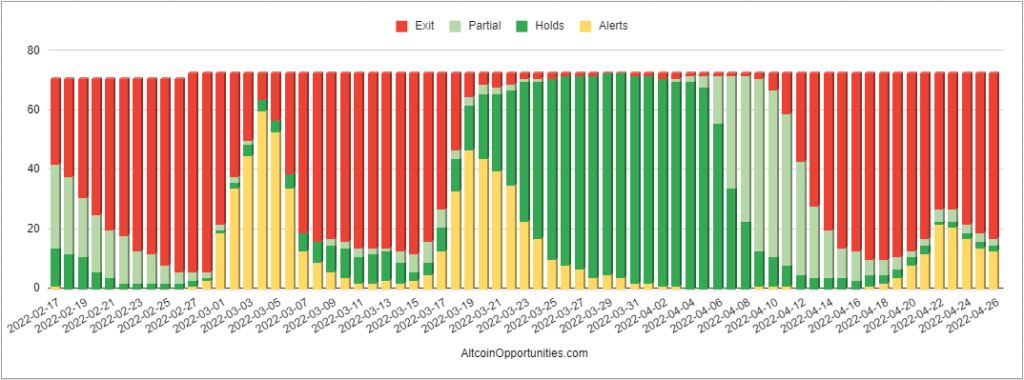

Tracking data of the Altcoin Seasons over time helps us prepare for what may come next with the best cryptocurrencies for 2024.

Dedicated daily altcoin index review to gather the data and long term analysis have let us learn how to look inside the general cryptocurrency trend data of bitcoin dominance and get specific about the best performing dApps, tokens and NFT markets.

Each different wave of altcoin performance can be compared over time to help us better understand the fakeout patterns from the profit-making trends.

As our data is presented in different views, it provides us with an educated perspective about the confirming moments in the trend change – as well as identifying the hottest moments of risk exposure to guard against potential losses.

➜ Altcoin Season Livestream on YouTube!

Our Job As Traders

Our only work is to manage risk. We don’t actually make the money. Our money is tasked with that job and we just position the money and protect it against risk.

We don’t know the future.

And we sure don’t know which one of these coins will pump or crash.

So we must diversify small across all that pass our mark.

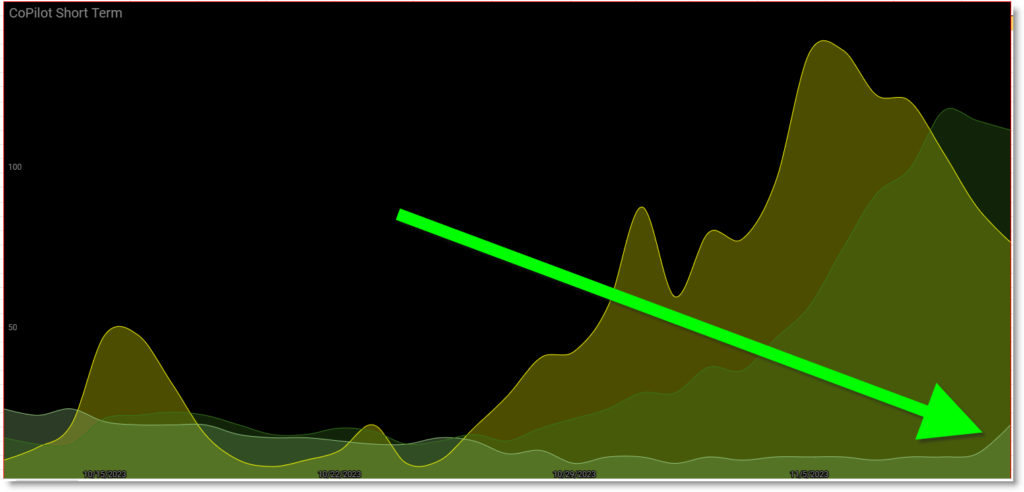

And then we manage risk. So our job now is to watch for any of the HOLD status coins to pull back into Partial Hold.

To me – that is a warning to protect my assets.

But I just Got REKT

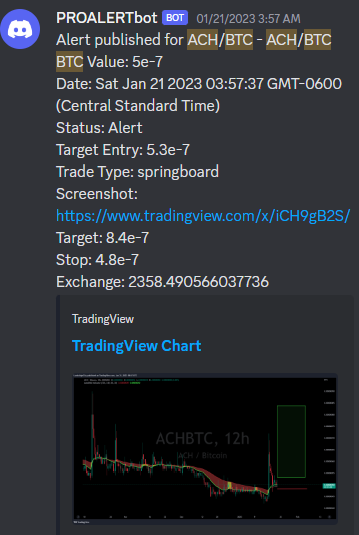

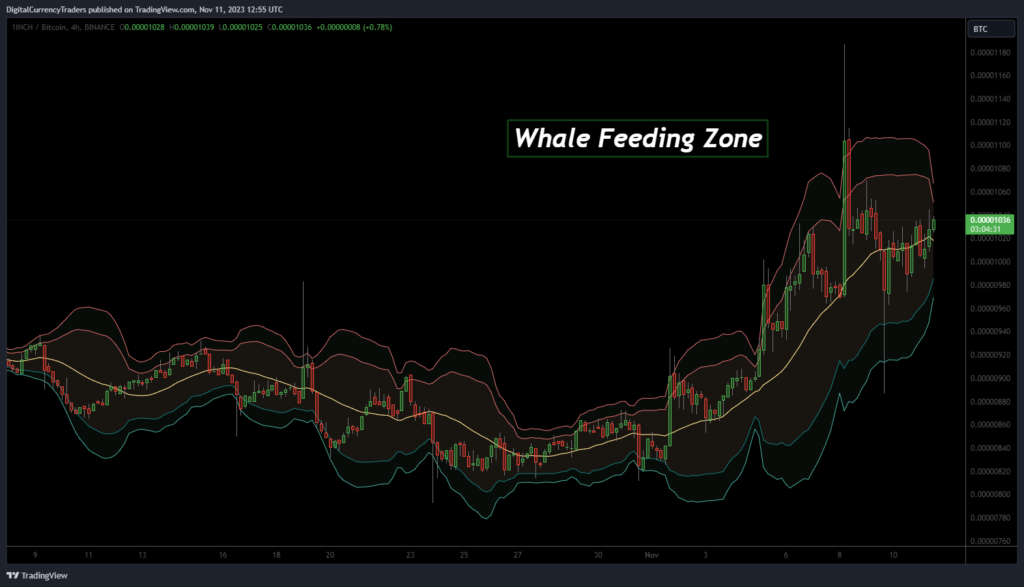

Look at the murderous price swings that ripped apart so many leveraged traders the past few days.

The stories of liquidations are sad to read.

But our system is prepared for this and expects it actually.

It will happen several more times in the months to come.

I call it Whale Feeding Zone, and your stop loss levels need to be ready for it.

So many exciting charts setting up right now!

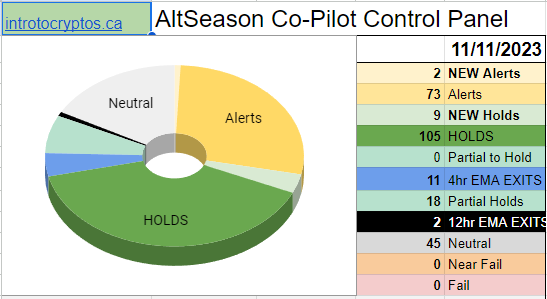

The 105 coins in HOLD status may still have opportunities to consider, yet most of those will be higher risk now that they have already passed our entry signal.

Any of the Partial Exit coins that move back into FULL HOLD status are worth a look for some explosive continuation potentials.

BE WARNED

If the 4 hour EMA EXITS start to pick up – that is a warning and we should be reviewing the charts for our EXIT signals.

The Daily Action Matrix Makes It Simple

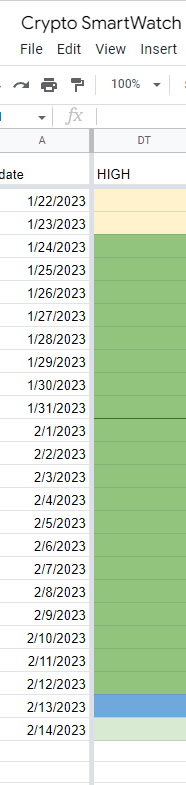

The Five Stages of The Trade make all of our action points very clear – so we can scan 270+ cryptos every day and sort the data to bring us a control panel that presents only the coins that are passing an action point.

We don’t have to personally scan the price charts to find the best and most important action movers – that info is brought to us.

Created By Crypto Portfolio Managers

➨ We created and improved our interface to make our jobs as easy as possible – and objective as our trading approach should be.

Some of our members are portfolio managers and they can explain every trade they are holding.

Nothing is left to chance in such a risky game. Every step of the trade is carefully planned well in advance. The diversification is a key component of the plan.

How Crypto Portfolio Managers See Risk:

Rebalance three pools of money to match the cryptocurrency price trends.

Trading the triad of Bitcoin/Cash/Altcoins at the right time is a key component of the plan… every detail works together with a logical part to play in the over all plan.

Oh ya – and you can learn for free.

There are so many crypto scams out there – proof is in the plan. So we give it to you so you understand it. Putting the plan into action takes work and research and that’s where our membership provides so much value to real traders.

The work and research is also what clears out the gamblers who try to follow our trading system.