Do you find yourself struggling to identify profitable altcoin investments in the ever-changing cryptocurrency market?

Are you tired of wasting precious time and resources trying to predict the next big altcoin winner on your own?

If you seek a proven solution to maximize your returns during altcoin seasons, then look no further.

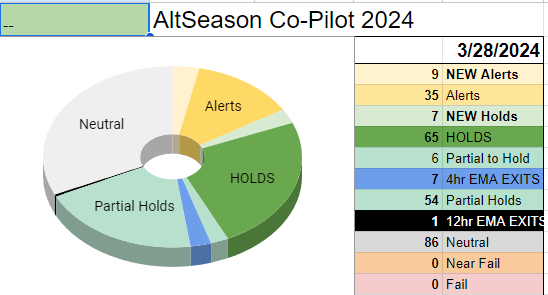

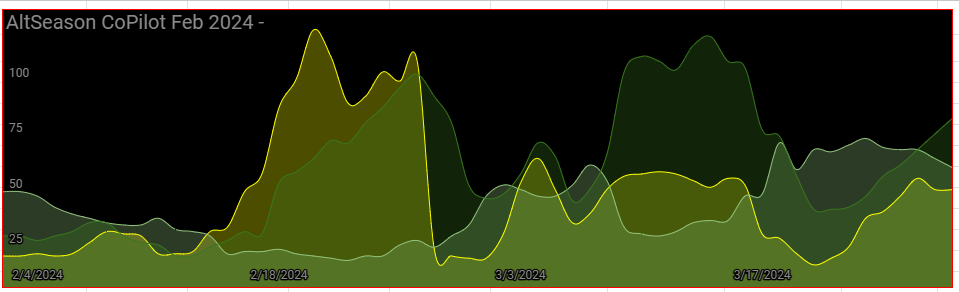

The AltSeason CoPilot report for 2024-03-28

Introducing The AltSeason CoPilot: A data-driven trading tool designed to help investors profit from altcoin price surges during altcoin seasons.

Why it’s amazing? The AltSeason CoPilot utilizes a precise crypto trading plan, providing investors with a strategic edge in capturing significant gains during the altcoin season phenomenon.

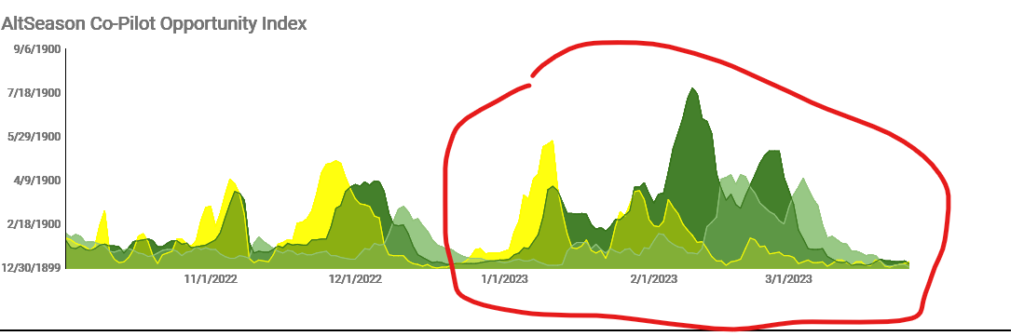

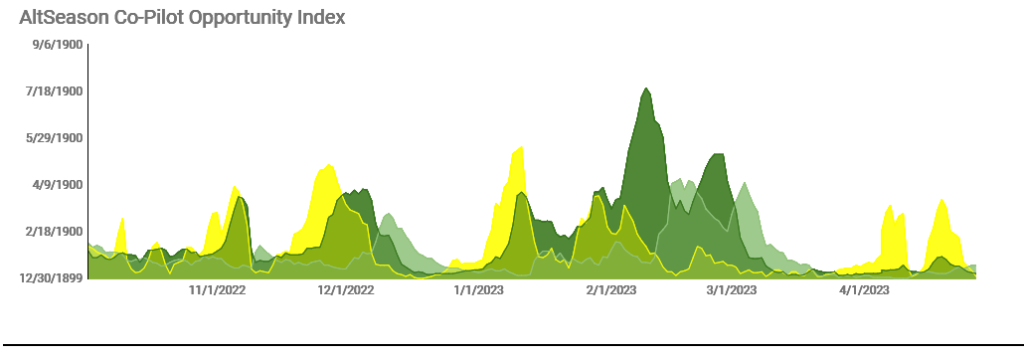

Crypto Landscape Heading Into April

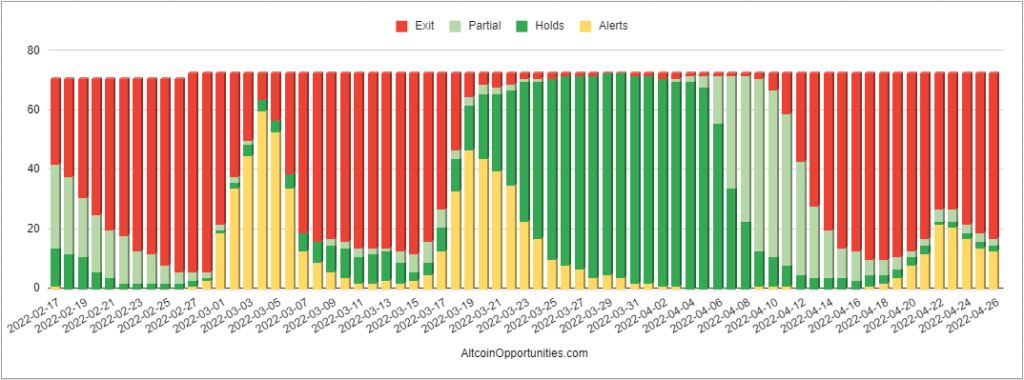

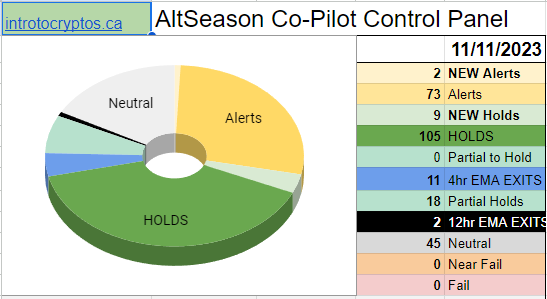

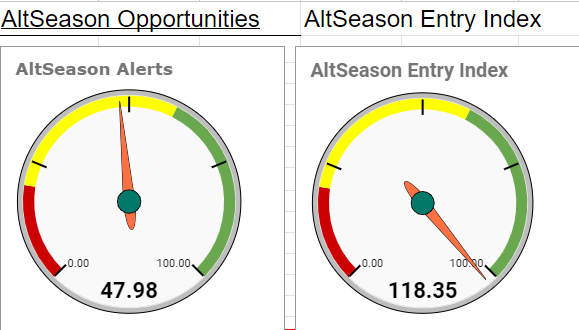

The AltSeason CoPilot’s algorithms have identified key market signals that suggest a bullish sentiment in the altcoin sector:

New Alert Status Coins: There are 9 new coins that have triggered alerts for potential entry points, indicating a strong possibility for price increases.

New Hold Status Coins: A count of 7 coins has transitioned to a ‘Hold’ status, recommending that investors maintain their positions in anticipation of continued growth.

Partial to Hold Status Coins: 6 coins have shown enough positive movement to suggest partial investments or to hold existing positions, reflecting moderate confidence in their future performance.

Conversely, certain indicators signal caution within the altcoin market:

Partial Exit Status Coins: 7 coins are currently flagged for partial exit, indicating a potential decrease in their price or a slowing of their momentum.

Exit Status Coins: There is 1 coin with an ‘Exit’ status, suggesting that it may be time to completely divest from this asset as it might not recover or participate in the bullish trend.

Based on these observations, it appears that the sentiment within the altcoin market is broadly bullish with 22 coins showing positive signs versus 8 indicating a need for caution or exit.

## Cryptocurrency Market Summary

Below is a summarized table reflecting the current AltSeason CoPilot signals.

| Signal Type | Number of Coins |

| ——————– | ————— |

| New Alert Status | 9 |

| New Hold Status | 7 |

| Partial to Hold | 6 |

| Partial Exit Status | 7 |

| Exit Status | 1 |

Traders and investors leveraging the AltSeason CoPilot’s insights should always keep risk management as their priority, being aware of the market’s volatility and the unique challenges posed by cryptocurrency trading.

The approach suggested here encourages a diversified portfolio strategy, spreading investment across a range of cryptocurrencies to reduce risk while positioning for potential high-value movements in the market.

Remember that market conditions can change rapidly and adaptability, coupled with sound judgement, remains key to successful trading in the crypto space.

Key Trading Tips To Remember

The following article was created based on our unique trading approach. Grab your copy of our Free crypto trading plan PDF and chat with our AI assistant instructor. Join thousands and learn to profit from trend trading.

Solve the Common Trading Mistake

How I Solved the Common Trading Question: Which Coin Should I Hold?

Before:

Wasted time and resources attempting to guess market trends and failing to spot profitable altcoin investments. Constantly second-guessing decisions, and falling victim to short-lived market volatility.

After:

Efficiently identifying potential high-performing altcoins during altcoin seasons, making informed investment decisions, and diversifying your portfolio to minimize risk. Imagine the freedom of securely growing your wealth in a thriving, unpredictable market!

Case Study

Check out our Bitget Copytrader account, posting a 364% closed ROI profit in just three months.

How The AltSeason CoPilot Works

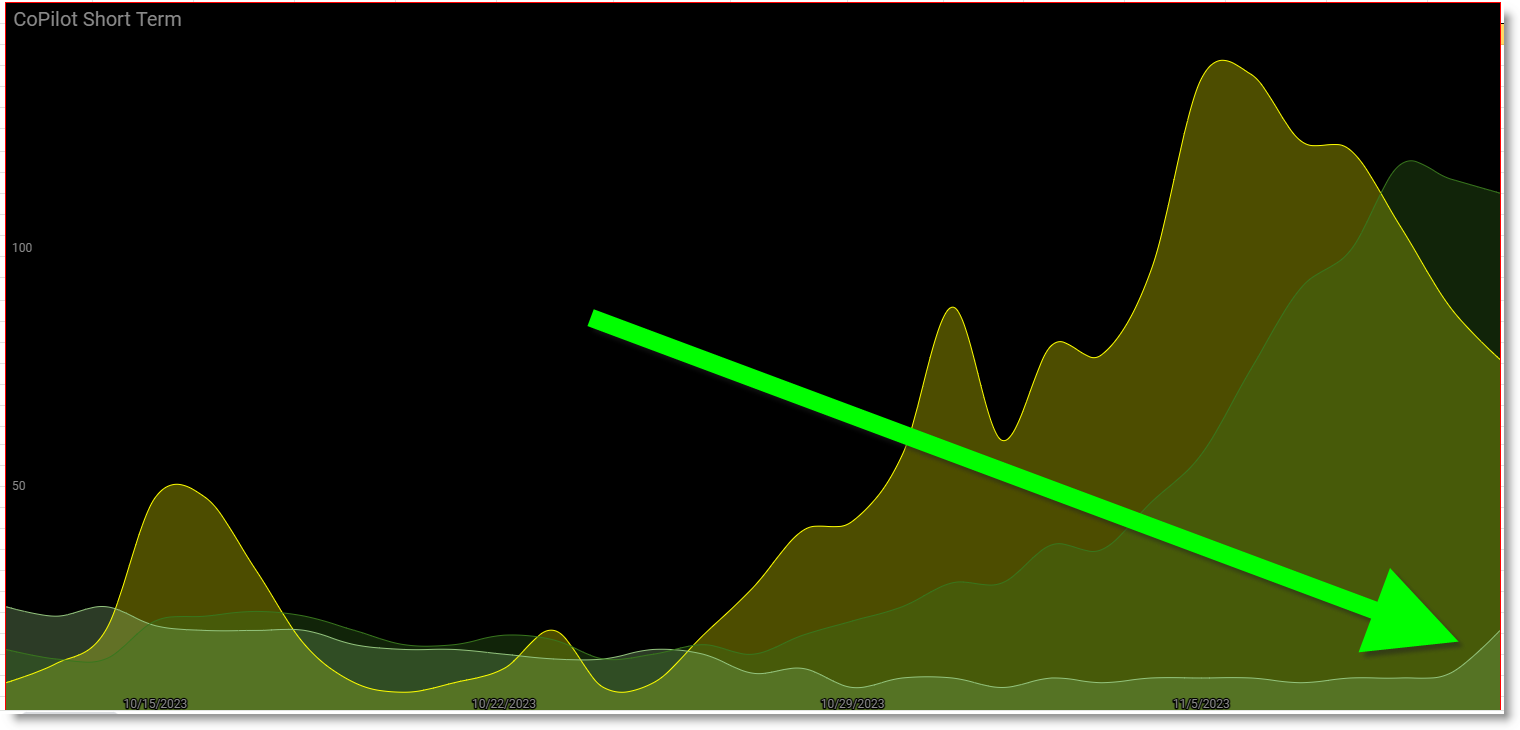

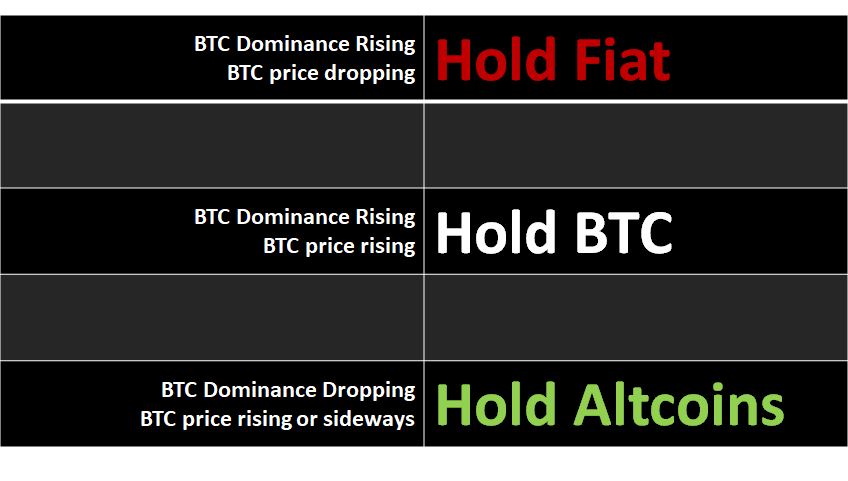

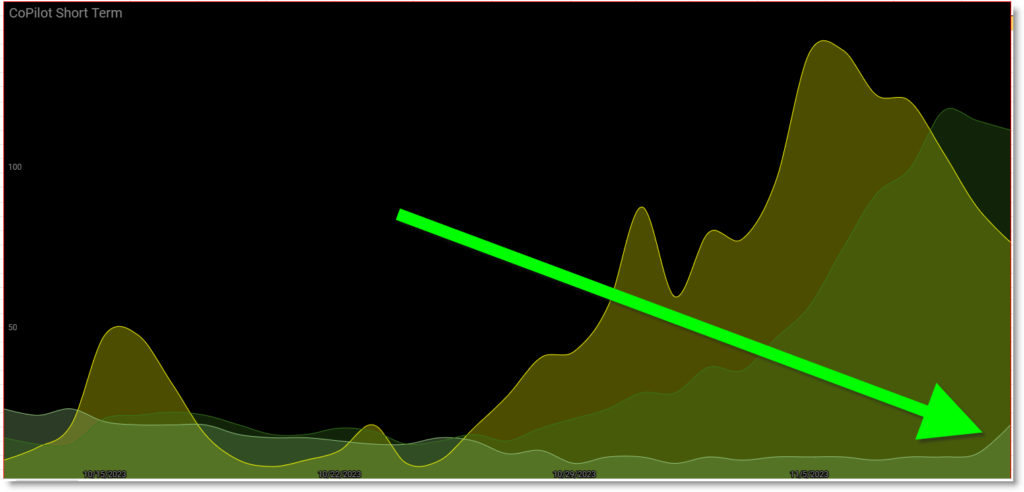

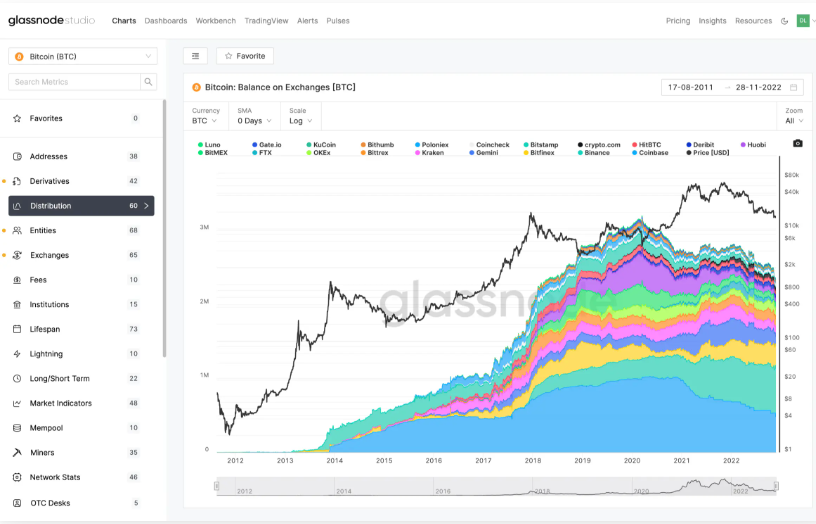

Step 1: Monitor Bitcoin dominance and stable coin trends to determine market sentiment.

Step 2: Utilize The AltSeason CoPilot’s daily action matrix to pinpoint high-potential altcoins.

Step 3: Implement risk management strategies and allocate funds wisely.

Step 4: Benefit from increased profits during altcoin season trends.

Check out our 7 Day Trial and start navigating the complex cryptocurrency landscape with The AltSeason CoPilot.

This post was created from the AltSeason CoPilot data using ChatGPT, Perplexity AI with Make.com automation.

Sign up for the AltSeason CoPilot. Each day we manually review each altcoin/btc chart and we update the trade status as we rebalance our model portfolio from day to day. The pie char above is our Altseason Index.