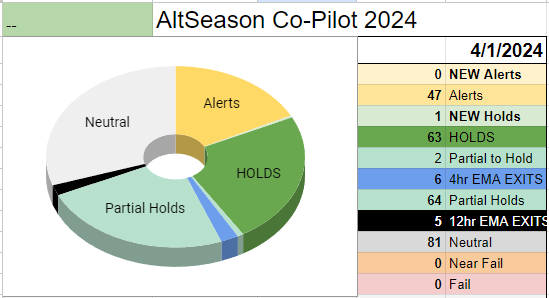

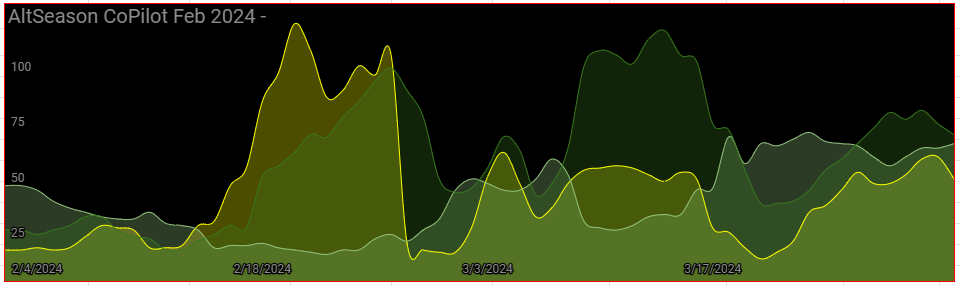

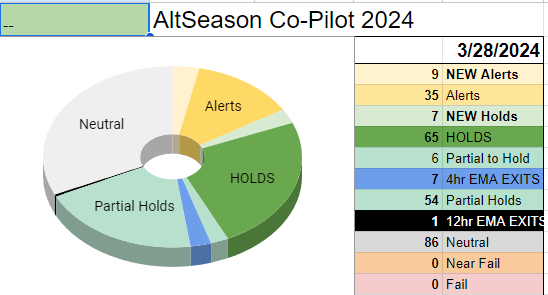

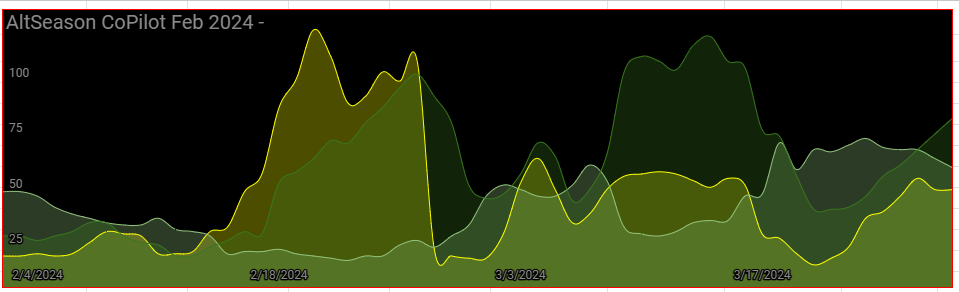

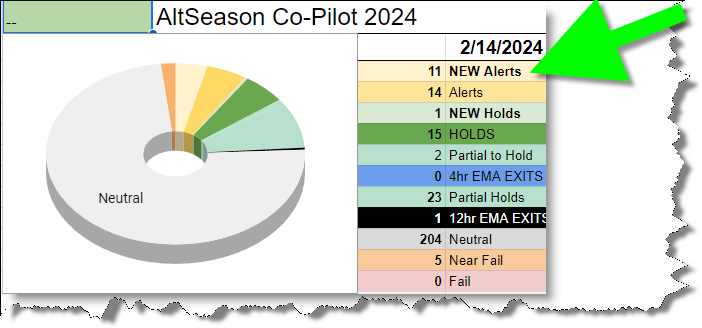

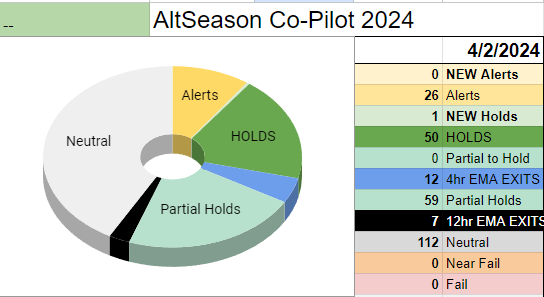

The recent data from the AltSeason CoPilot spreadsheet reports a limited presence of bullish signals within the altcoin sector.

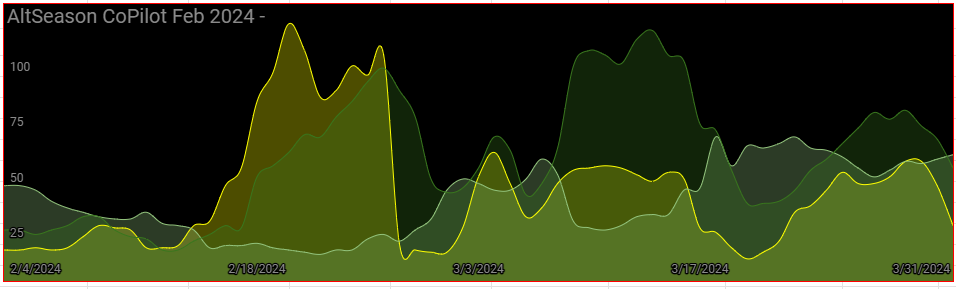

The AltSeason CoPilot’s analytical systems have recently identified current market trends that are signaling a mixed sentiment among market participants.

Presently, we are observing that there are zero new coins in the “New Alert” status and only one coin has been placed in the “New Hold” status.

There are no coins transitioning to the “Partial to Hold” status, pointing to a cautious approach from investors.

On the contrary, the data indicates stronger bearish signals, with a significant number of coins in both the “Partial Exit” and “Full Exit” statuses.

Specifically, there are 12 coins falling under the “Partial Exit” status, suggesting a strategic retreat or reallocation of resources in response to market conditions. Furthermore, 7 coins are now in the “Full Exit” status, indicating a recommendation to fully close positions on those assets, hence confirming a more widespread defensive stance.

The mixed sentiments expressed through the AltSeason CoPilot signals show a market that is cautiously optimistic yet prepared for potential adverse movements.

| New Alert | New Hold | Partial to Hold | Partial Exit | Full Exit |

|---|---|---|---|---|

| 0 | 1 | 0 | 12 | 7 |

Key Cryptocurrency News:

- Crypto Market Liquidations: The cryptocurrency market experienced significant liquidations, with over $400 million in bullish bets being liquidated. This was primarily due to a sharp decline in major tokens such as Bitcoin, Ether, Cardano’s ADA, and BNB Chain’s BNB. Solana and Dogecoin were among the hardest hit, with Solana dropping 7% and Dogecoin more than 8%14.

- Bitcoin’s Price Movement: Bitcoin’s price fell by approximately 5.8% to $66,398, influenced by stronger dollar conditions and the release of US manufacturing sector data for March, which rose more than expected17.

This decline was part of a broader market pullback, with Bitcoin struggling to consolidate above the $71,000 level due to resistance and broader market caution against riskier assets1. - Dogecoin’s Significant Drop: Dogecoin’s price experienced a notable decline, crashing 14% amid the broader market pullback. This was part of the overall trend of major cryptocurrencies facing downward pressure5.

- Overall Market Sentiment: The global cryptocurrency market has notably declined, with Bitcoin dipping close to the $66,000 mark. This downturn is attributed to a combination of factors including a stronger dollar, strategic profit-taking among long-term holders, and broader market caution16.

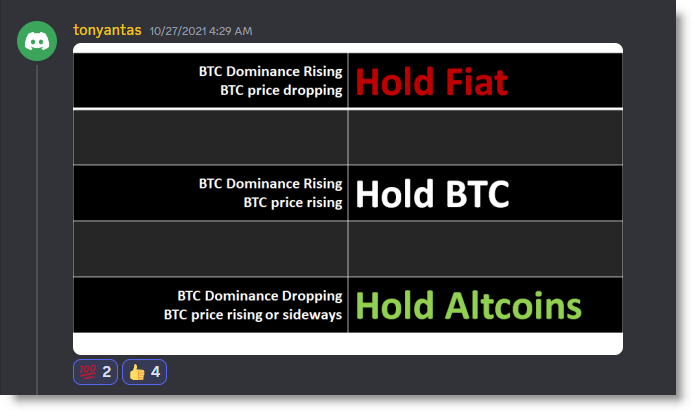

The AltSeason CoPilot approach emphasizes the importance of risk management and diversification in trading.

By leveraging data-driven insights and a rigorous trading plan, the strategy aims to navigate through the volatile waters of the cryptocurrency market safely.

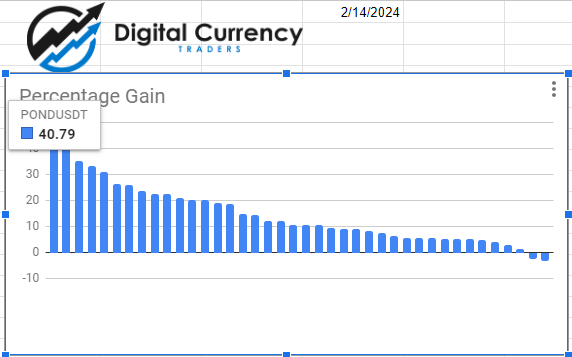

It endorses entering and exiting trades based on meticulous analysis rather than speculative impulses, reducing exposure during bearish periods and capitalizing on bullish markets by identifying strong performers amongst altcoins.

Key Trading Tips To Remember

This article was created based on our unique data and trading approach. Access everything with our 7 day trial. Join successful thousands and learn to profit from trend trading.

This post was created from the AltSeason CoPilot data using ChatGPT, Perplexity AI with Make.com automation.

Sign up for the AltSeason CoPilot. Each day we manually review each altcoin/btc chart and we update the trade status as we rebalance our model portfolio from day to day. The pie char above is our Altseason Index.

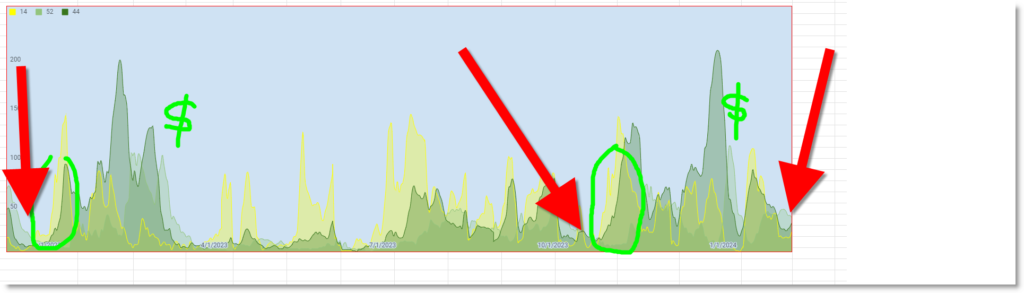

In summary, current assessments advise a more guarded positioning, focusing on maintaining the value of existing portfolios while remaining vigilant for emerging opportunities.

The approach fosters disciplined trading, ensuring investors can pivot with agility and confidence, always aligned with the prevailing market narrative and risk appetite.