It’s one of those nights where anticipation hangs in the air, just like the flickering candle on my desk.

Bitcoin’s price is dancing on the trading screen, and traders everywhere are on edge.

The much-awaited “Omni candle” hasn’t appeared yet, but the excitement is palpable.

Our Bitcoin Liquidation Watch livestream on YouTube is buzzing as we prepare for this big move.

The Bitcoin Trading Journey Begins

Like many traders, my early days in Bitcoin trading were filled with frustrations. I pored over candlestick charts, trying to decipher their stories.

The learning curve was steep, and my efforts often felt like fumbling in the dark. But each setback was a lesson, teaching me that understanding market psychology is as crucial as the numbers.

Bitcoin Supply Crisis is Critical

One night, while browsing a trader’s forum, I stumbled upon a discussion about the “Omni candle.” Intrigued, I dove deeper.

The term describes an exceptionally large price candle on a trading chart, signaling a significant price movement.

This was the clue I had been searching for, a hunch I’ve had for a while.

Here’s a report from Perplexity AI to explain more:

Will bitcoin supply hit a point of inflection?

The concept of a “point of inflection” in the context of Bitcoin supply can be interpreted in several ways, particularly in relation to its supply dynamics and market behavior. Here are some key points to consider:

Bitcoin’s Supply Dynamics

Fixed Supply Cap: Bitcoin has a hard cap of 21 million coins, which is a fundamental aspect of its design to ensure scarcity and prevent inflation. This cap is enforced by the Bitcoin protocol and is unlikely to change due to the decentralized nature of the network and the consensus required to alter such a fundamental rule.

Halving Events: Bitcoin undergoes halving events approximately every four years, where the reward for mining new blocks is cut in half. This process reduces the rate at which new bitcoins are created, contributing to the scarcity of the asset. The next halving is expected to occur around April 2024, reducing the block reward from 6.25 BTC to 3.125 BTC.

Mining and Transaction Fees: As the block rewards decrease over time, miners will increasingly rely on transaction fees for their income. This shift could impact the economics of mining and the overall transaction costs on the network.

Market Implications

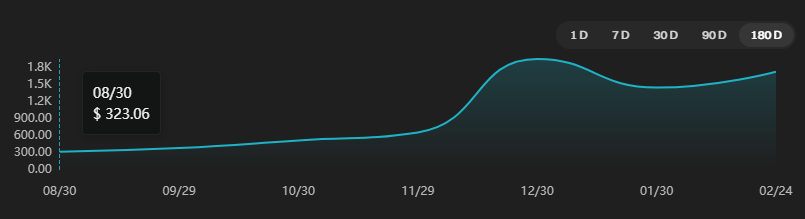

Scarcity and Value: The halving events and the fixed supply cap are designed to create scarcity, which can drive up the value of Bitcoin if demand remains constant or increases. Historical data suggests that Bitcoin’s price tends to rise following halving events, although this is not guaranteed.

Inflection Points: Analysts often discuss potential inflection points in Bitcoin’s market behavior, particularly around halving events. These points are seen as critical junctures where the dynamics of supply and demand could lead to significant price movements. For instance, the upcoming halving in 2024 is viewed as a potential inflection point due to the anticipated reduction in new supply and the historical trend of price increases post-halving.

Market Sentiment and Holder Behavior: The distribution of Bitcoin among holders and their behavior can also influence market dynamics. For example, long-term holders (HODLers) selling their coins to new market participants can signal shifts in market sentiment and potentially lead to price volatility.

Conclusion

While the fixed supply cap and halving events are predictable aspects of Bitcoin’s supply dynamics, the market’s response to these events can create points of inflection.

These inflection points are characterized by significant changes in price and market behavior, often driven by the interplay of scarcity, demand, and investor sentiment.

The upcoming halving in 2024 is widely anticipated as a potential inflection point, with many analysts expecting it to have a substantial impact on Bitcoin’s market dynamics

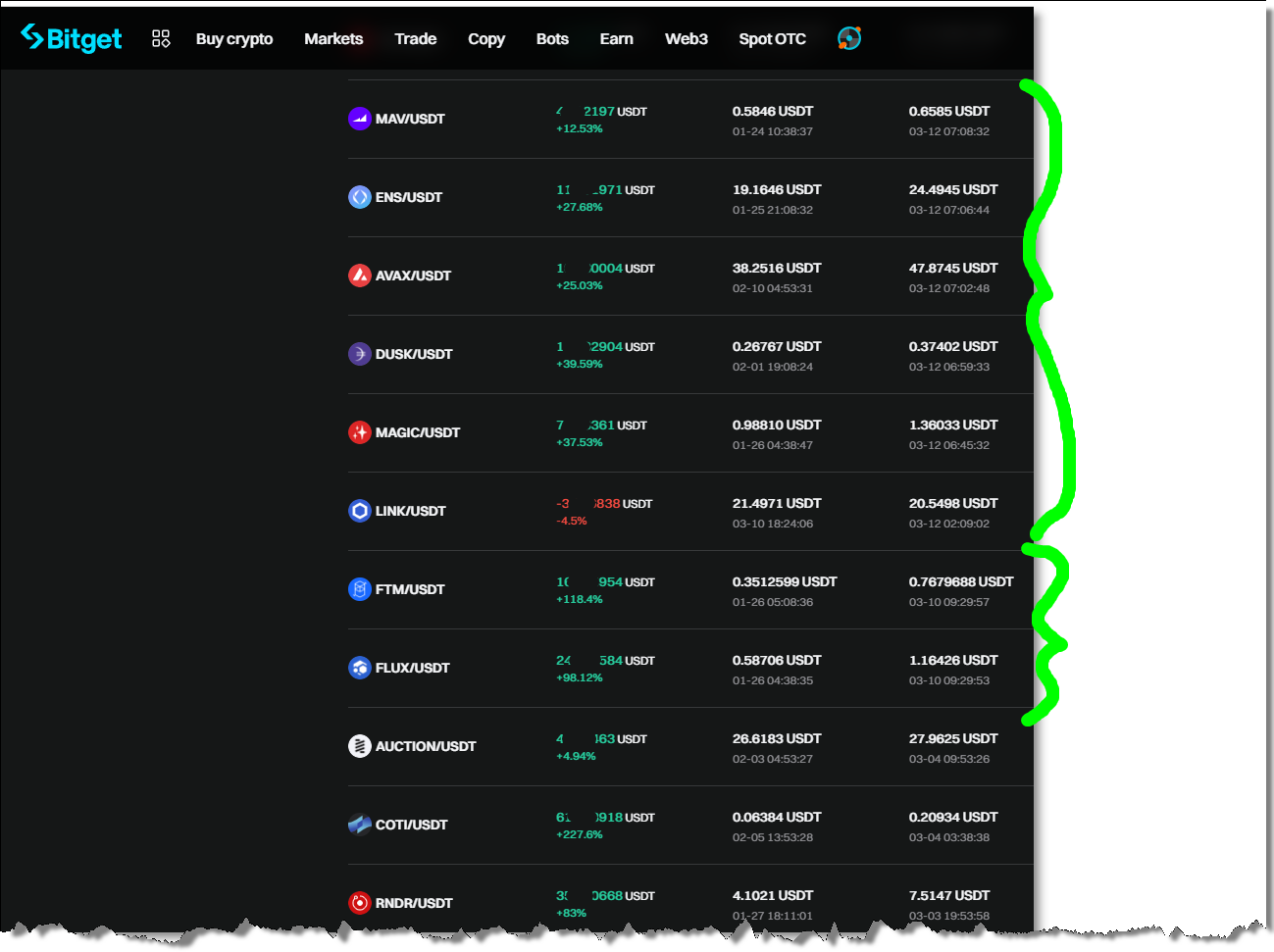

Armed with this new insight, I revisited my charts.

It was like seeing a hidden pattern emerge from the chaos.

The Omni candle wasn’t just a random occurrence; it was a beacon signaling strong volume and momentum. It hinted at market sentiment shifts, potential trend reversals, or continuations.

Preparing for this might be a game-changer.

Time to Prepare

The candle is expected to be massive, dwarfing its neighbors, and I am confident all my waiting would be worth while.

But, as is often the case in trading, reality has not matched my expectations.

Exploration for Sustainable Strategies

Determined not to give up, I started a livestream channel to monitor Bitcoin Price.

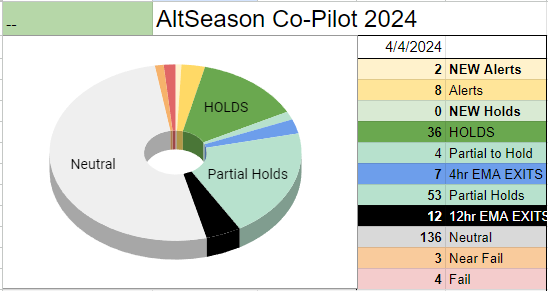

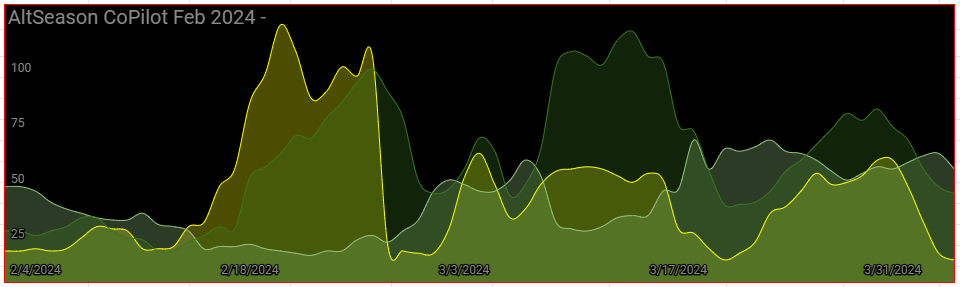

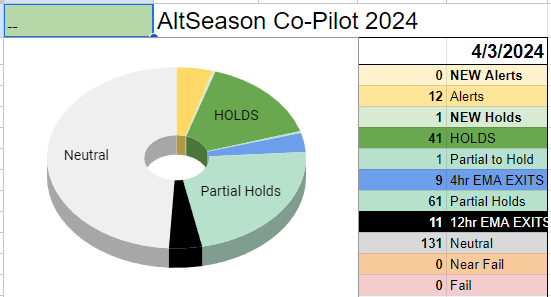

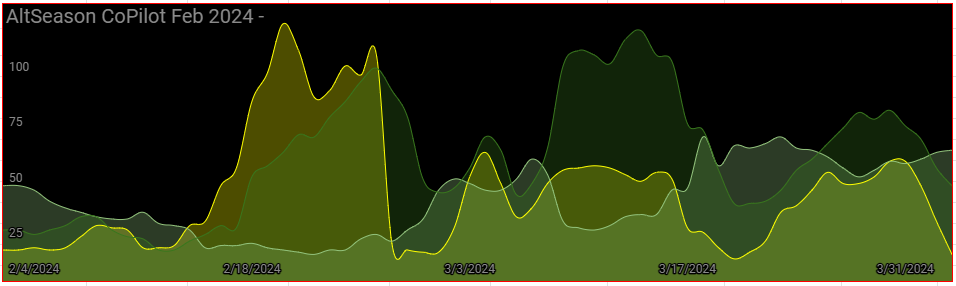

I realized the importance of smart work over hard work, focusing on an automated trading strategy rather than my opinion.

Awaiting the Omni Candle

Reflecting on my struggles, I began to understand that it was not just about spotting a large price movement but understanding what it represented.

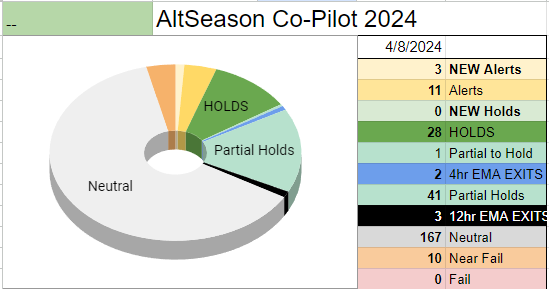

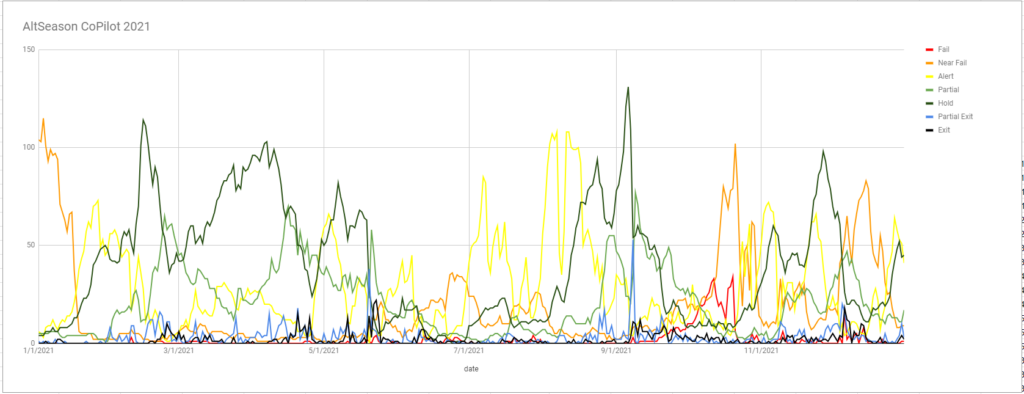

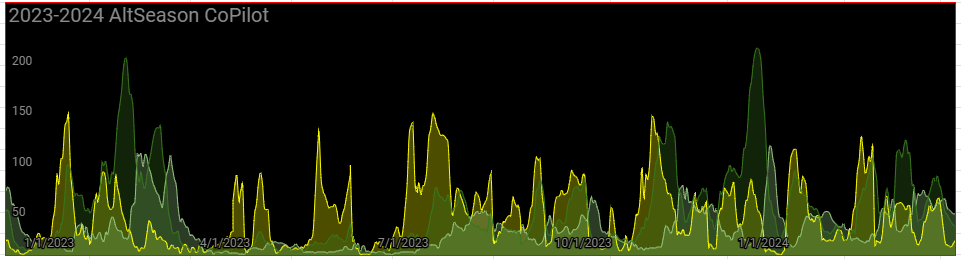

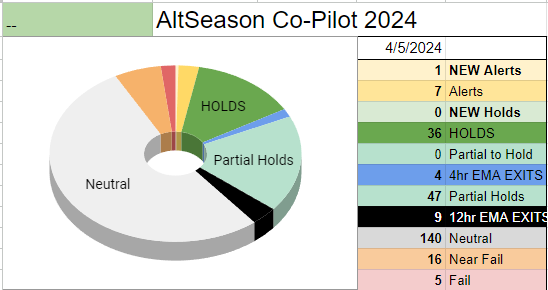

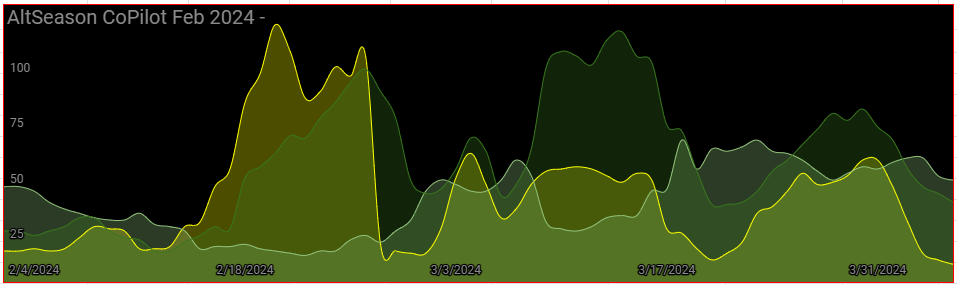

I observed that reversal patterns often appeared at critical inflection points, signaling potential shifts in market sentiment.

By combining this with analysis of US Dollar Index, precious metals and other indicators, I started developing a more robust understanding.

The OMNI: A New Financial Era

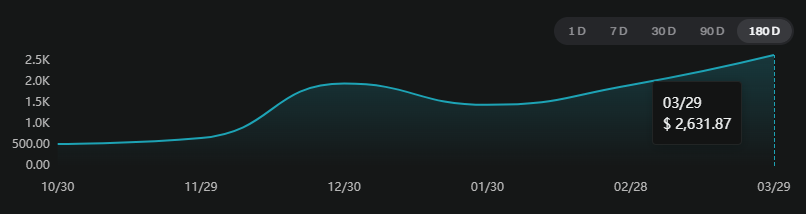

With renewed focus, I decided to put my new understanding to the test.

I am positioned and wait patiently for the right conditions to create the perfect storm in the financial world—a significant Omni candle accompanied by strong volume and supportive technical indicators.

When the moment comes, I’ll reap the benefits of my preparation, because of my strategy.

Implementing the Strategy: Steps to Success

Step 1: Understand the Candlestick Basics

- Learn to read candlestick charts: opening price, closing price, highest and lowest prices.

Step 2: Identify the 1-2-3 Pattern

- Look for trend reversal patterns and EMA crossover, signaling significant price movement.

Step 3: Analyze the Context

- Consider the broader market trend and other technical indicators.

- Validate the Omni candle’s signal with US Dollar Index analysis.

Step 4: Execute with Caution

- Implement trades with a clear plan and risk management strategy.

- Look for follow-through in subsequent candles to confirm the signal.

Tips for Aspiring Traders

- Stay Informed: Keep learning and stay updated with market trends.

- Use Tools and Resources: Leverage available trading tools and learn from experienced traders.

- Practice Smart Work: Focus on a holistic strategy rather than relying on single indicators.

- Be Patient: Wait for the right conditions before executing trades.

Conclusion

Understanding the Omni candle has the potential to transform the global financial systems.

It’s more than just a large price movement; it’s a signal that my be the biggest financial shift in history.

By preparing for this potential, you may turn very small action into very large success.

Explore your unique talents, keep learning, and don’t be afraid to start small. The world of cryptocurrency trading is dynamic, and with the right strategy, the potential for success is immense.

Call to Action

Join us on the Bitcoin Liquidation Watch.

Subscribe to our free newsletter for more insights and support on your trading journey. Thank you for being a part of this adventure.