Web3 refers to the third generation of the World Wide Web, which aims to bring the power of decentralized technology to the internet. To find if can profit from Web3 we need to understand where the value flows through the blockchain technology, which allows for the creation of decentralized applications (dApps) that can run on a decentralized network, rather than on a single centralized server.

Should we invest in API3

In the same way that it may be prudent to invest in Layer 1 Coins, as the underlying Web3 network gains more dApps, the value of the entire ecosystem grows. Explosive growth is anticipated when a large establish app chooses to relocate to a Web3 backbone because of the many efficiencies.

While positioning before the explosive growth is a good idea – managing risk is always a first priority.

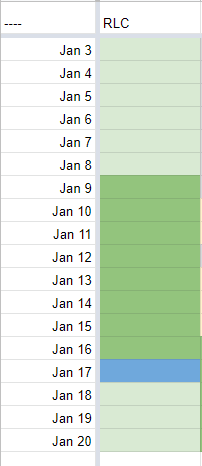

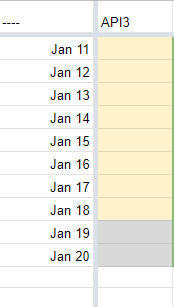

It is important to pay close attention to the ebb and flow of altcoin seasons. The cryptocurrency sector trends together and must be an important part of choosing when to hold or release the API3 token.

API3 is another one of the 300+ tokens in the Crypto SmartWatch model portfolio tracker.

Build on all Blockchains from one place

API3 is a protocol that aims to make it easier to create and deploy dApps on the Web3 stack.

Built on the Chainlink protocol for its ability to automate and streamline business processes, API3 allows developers to access the functionality of different blockchain networks, such as Ethereum, through a single API.

Access different blockchain networks through a single protocol.

This means that developers do not need to learn the specifics of each blockchain network they want to build on, and can instead use the API3 protocol to access the functionality they need from various blockchains.

The API3 protocol also aims to provide a way for dApps to access data from different sources, such as web services and external databases, in a decentralized manner.

What is a First-Party Oracle?

Legacy third-party oracle networks and first-party oracle solutions are two different types of oracles that are used to provide data to smart contracts on a blockchain.

A legacy third-party oracle network is a decentralized network of nodes that gather data from external sources and provide it to smart contracts on the blockchain. These oracles are typically operated by third-party entities and are not directly controlled by the smart contract creators or users. They can be used to access a wide variety of data sources, including APIs, websites, and other off-chain systems. However, because they are operated by third-party entities, there is a risk that the oracle network may be compromised, leading to inaccurate or unreliable data being provided to the smart contract.

On the other hand, a first-party oracle solution is a system in which the smart contract creator or user directly controls the oracle and the data it provides. This can be done by hardcoding the data into the smart contract or by using a decentralized application (dApp) that interacts with the smart contract to provide the data. Because the oracle is directly controlled by the smart contract creator or user, there is less risk of inaccurate or unreliable data being provided to the smart contract.

Learn more about first-party oracle solutions that are directly controlled by the smart contract creator or user, and how that makes them more reliable and secure.

Web3 dApps using API3

Here are a few dApps that are using the API3 protocol:

- ChainGuard: A security protocol that uses API3 to provide a secure and trustless way to access APIs.

- The Ocean: A protocol for data marketplaces that allows data providers to monetize their data by selling access to it through API3.

- OceanDAO: A autonomous organization (DAO) built on the Ocean protocol that allows its members to vote on proposals and make decisions about the protocol’s development.

Please note the above-mentioned dApps are in development stage and their status and functionality can change over time.

To answer the question ‘Can We Profit From Web3?‘ – the answer is a strong yes – if we time our entry with this popular AltSeason TradingView Indicator.

As the underlying Web3 network gains more dApps, the value of the entire ecosystem will grow. Explosive growth is anticipated when a large establish app chooses to relocate to a Web3 dApp backbone because of the many efficiencies.

Can We Profit from Web3?

— introtocryptos.ca (@introtocryptos) January 20, 2023

As the underlying Web3 network gains more dApps, the value of the entire ecosystem grows. Access different blockchain networks through a single protocol with $api3 https://t.co/Vne7gDHmAO@API3DAO #web3community #web3jobs pic.twitter.com/dI6GeylVdT