The highly-anticipated Altcoin Season Indicator is finally available on GumRoad, and it’s a total game-changer. Here’s why this is the most exciting news in crypto trading right now!

Say goodbye to common trading mistakes like hesitation and early profit-taking. The indicator and automation will eliminate human errors, ensuring you make the most out of every trade.

- First I’ll share the successful history of this trading approach

- I’ll share some of my $500,000 profit reports

- I’ll show you the trading indicator research and development

- I’ll explain why I am firing myself as a trader

- I’ll detail the automated backtesting with thousands of settings

- I’ll share how the big data is fine-tuned with Artificial Intelligence

- I’ll give tips on how I am automating for Altcoin Season Profits

➤ Buy it Here

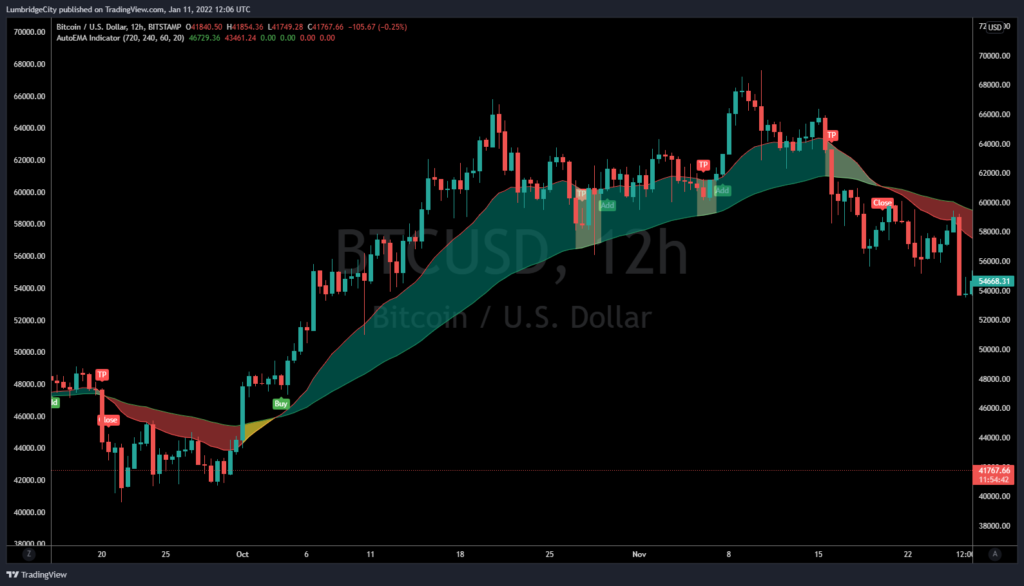

Trading the BTC/USDT pairs against the US DOLLAR is a standard measure.

The following charts demonstrate how our trading indicator handled the recent bull waves in Bitcoin price.

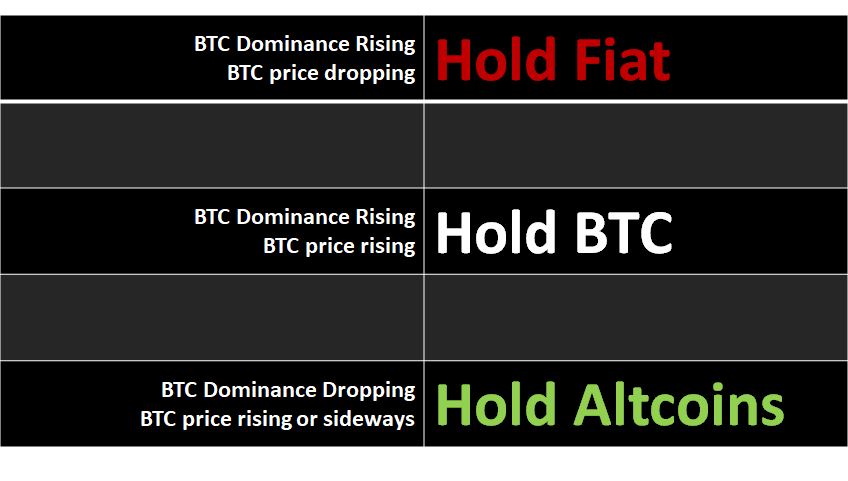

When Should We Hold Altcoins?

We can also trade altcoins against their us dollar value. This is a good strategy while Bitcoin Dominance is rising and Bitcoin price is dropping or sideways.

However, when it is Altcoin Season – that means that Bitcoin price is rising and Bitcoin Dominance is dropping. This tells us that more money is coming into the altcoins than into Bitcoin.

➤ While Bitcoin price is rising and Bitcoin Dominance is dropping, we can grow our Bitcoin holdings faster by holding a select group of altcoins.

Inside Bitcoin Dominance

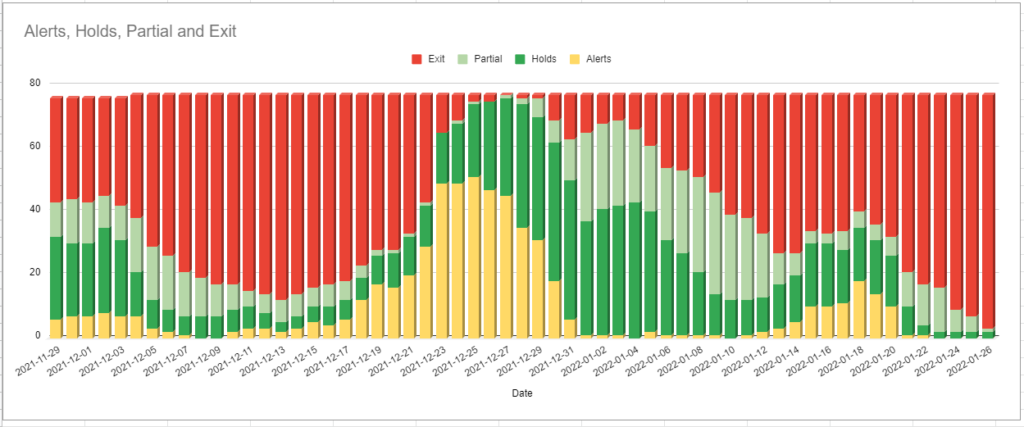

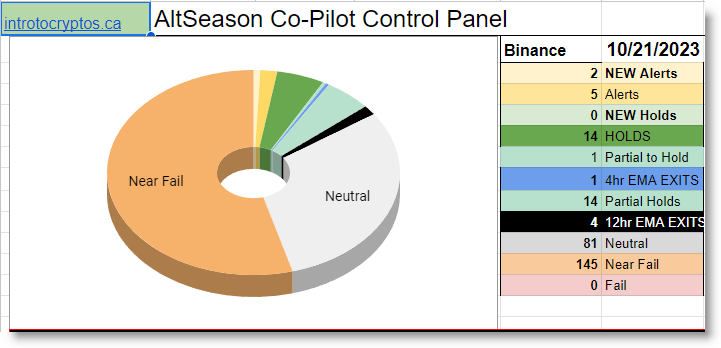

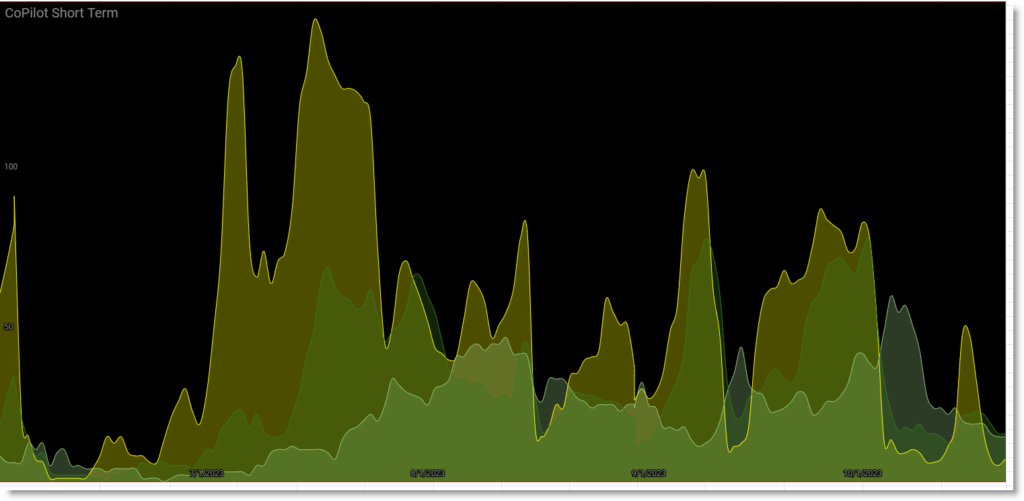

By analyzing all of the ALT/BTC pairs against a standard EMA cross, we can plot the daily data from 300 coins, and we can visually can see the shifts in the Altcoin Season trends.

When Altcoin Season trends begin to shift, the coin charts will naturally organize into a bell-curve of the best cryptocurrencies setting up.

➤ The daily data from the AltSeason CoPilot Spreadsheet provides an invaluable insiders view of Bitcoin Dominance.

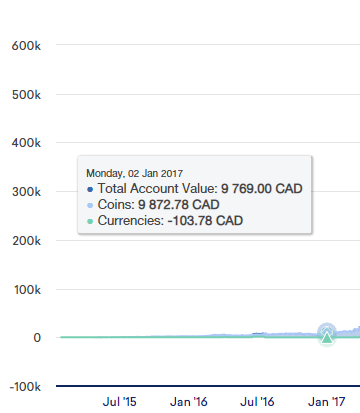

From Zero in 2015 to 500k in 2018

For example, back in 2015 I had started trading the 1-2-3 pattern with the 60/20 EMA cross on the 12 hour bars. And it works wonders. (get the free PDF and learn the entire trading plan)

From 2015 until 2017 I was able to earn and grow a nice stack of crypto with many small holdings.

I was not prepared for the HUGE profits that rolled in that year!

I’d never made that much money so fast before!

And in fact, during this amazing year, I made a $500,000 trading mistake because I did not understand the significance of Bitcoin Dominance.

$500k Trading Mistake Drives Research

Knowing that I could have turned my money into well over a million dollars if I had known one simple concept – I worked manically on the development of the AltSeason CoPilot Spreadsheet.

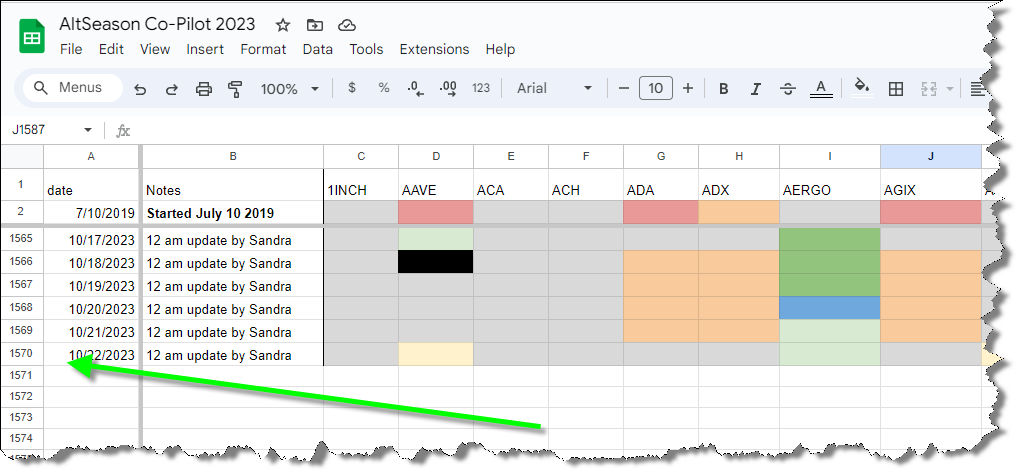

Together with my dedicated partner Sandra, we have manually updated the spreadsheet on 300 coins… for over 1570 days.

Manually marking the Altcoin Season Indicator trading signals into a spreadsheet so we can get a daily snapshot of where every crypto is standing.

As we plot the daily totals over time, the inside view of Bitcoin Dominance so we can identify the early coins in the bell curve as the momentum of altcoin season is beginning and ending.

Altcoin Season index showing the change in ALERT, HOLD and PARTIAL HOLD status coins over time.

Early Automated Trading Success

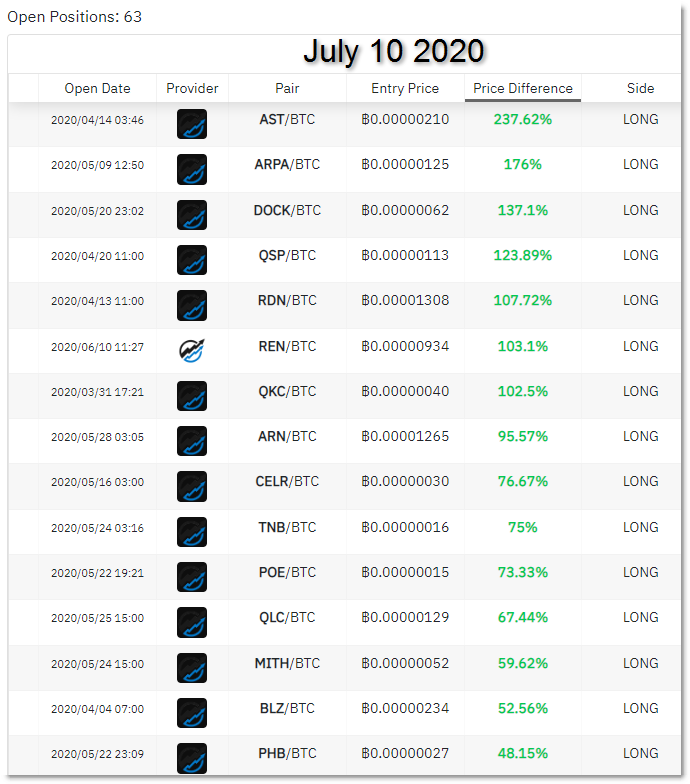

The trading system was automated on Zignaly for a time in 2020 and caught some amazing percentage gains in one of the waves of Altcoin Season back then.

But even though the general system has proven itself to work well for altcoin season after altcoin season, there was no way for me to test every different EMA setting against every different time frame setting…

My system ‘worked’ and I was practicing my trading skill to working the system.

The Spreadsheet Did Better Than Me

Since we designed the spreadsheet in 2019, year after year- for every single altcoin season without exception the AltSeason CoPilot has out-performed my own personal trading.

At first, this was a source of great distress.

Yet as a result of years of intense study I’ve been able to pinpoint many of my own trading mistakes.

Profitable Indicator Reveals My Errors

➤ My biggest trading mistake is to second guess the entries and not take action.

Why Does This Happen?

If my trades are small, then the risk is small – but it takes a lot of time to be getting back into coins that don’t give a clean breakout.

And, because I can never know which coins will do a good breakout, I get discouraged by the fakeouts and then I don’t take action and I miss the good ones.

By automating this stage of the trade, I can have my bot take that small action for me and it can do the work of managing risk and starting again and again when needed.

➤My second biggest trading mistake is taking profits too soon.

Why Does This Happen?

I get fearful that I’ll loose this profit like so many of the other fakeouts… so I take the profit to ensure that I have it – only to watch the market continue on without me.

Worse – later I’ll check back only to find out that the AltSeason CoPilot handled the volatility correctly and the spreadsheet made the gains that I missed.

If I trade small enough in many markets, I can be less emotionally attached to the success of any one coin.

By automating the trade management, I don’t micro manage the position while the trend surges and then comes back to test support.

Eliminate Common Trading Mistakes

When I put together the mistake of missing good entries and then the mistake of taking profits too soon – and I reflect on the human reasoning for those errors…

I can see that these biases and mistakes will certainly be a part of my future trades even though I am aware of them.

And – since the damn spreadsheet was doing better than my own trading through each cycle of the altcoin seasons… my ego finally let go of the need to be right about the price predictions.

Time to surrender to the better player

(and make more money)

Step One – Optimize

My conclusion is that the trend trading system really works.

Yet after becoming very clear about my own trading mistakes, I realize that I’ll never be able to clear some natural biases that a trading bot does not have.

So now that I’m going to automate, it’s time to test thousands of variations of the trading indicator to find our for sure if the 12 hour charts are better or maybe the 4 hour charts are better? Maybe the 1 hour charts may give us the best return.

What Are The Best Settings?

Optimizing The Indicator.

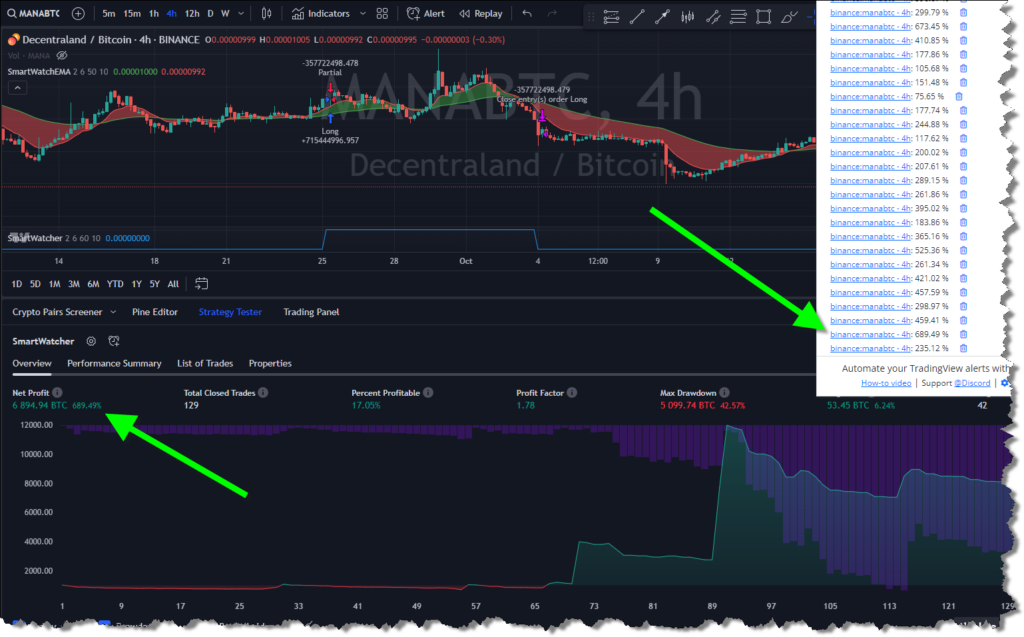

With the TradingView Strategy Finder Chrome extension you can fine-tune your TradingView strategies and maximize your profits.

The AltSeason CoPilot is essential for verifying the overall trend, yet it has never been optimized for the best performance until recently.

I used the TradingView Strategy Finder to systematically test hundreds of combinations across dozens of coins to find and verify the optimal settings.

Even though the Strategy Finder can process 135 different variations in under ten minutes, gathering all the optimization data required a few days of research.

As the data came in I would jump to the best settings with one click – and take a look to see where the entry and exit signals display on the chart in the Strategy Tester.

➨ Automated Backtesting Data

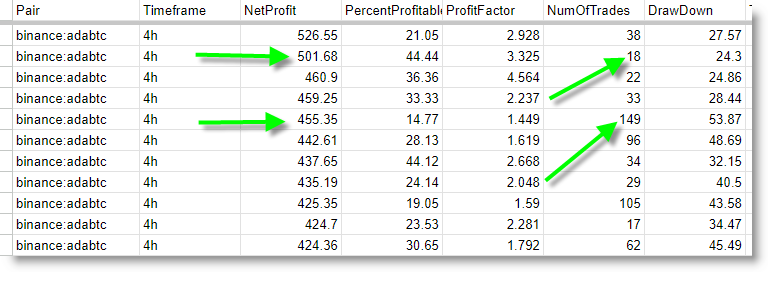

Then I exported the CSV of the data for everyone who purchases the optimized altcoin season indicator.

➨ AI Data Crunching

And now I’m seeking help to have artificial intelligence tools like ChatGPT to review the data and give us an overall perspective on the best average representative settings that we could use for our upgraded and optimized diversified approach.

and that I can work it pretty well –

Here Are Some Data Highlights

Deep Data Comparison

After running thousands of scans – importing and sorting the raw optimization data we can quickly see that the Percentage Gain is not the only important data.

We can manually sort and compare the number of trades, the percentage of trades that were profitable, the profit factor and the drawdown as part of our larger comparison of the best settings for the Altcoin Season Indicator.

Here we can see similar percentage gains, but the optimal setting will trigger fewer trades and provide a higher percent profitable ratio which ultimately reduces trading costs.

Again and again the Optimization Spreadsheet details critical insights that will improve my trading results even better than I could achieve in the past!

The indicator is the culmination of years of research and development.

Not only has it been backtested with thousands of settings, but now I am on the path to provide our complete data set to GPT-Trainer and learn how to use AI Tools to fine-tune the very best trade settings using Artificial Intelligence.

Now the Altcoin Season Indicator is ready.

The indicator optimization spreadsheet has already been helping our members!

Click HERE to buy the

Altseason Indicator for Tradingview

Step Two – Automate

More and more cutting edge trading automation services are coming online so it is important to review the benefits they may provide and the exchanges they can connect to.

Selecting a trading bot platform will depend on several factors that are beyond the scope of this post but I had successfully set up the Altseason Indicator to fire signals through Zignally to Binance and also had positive experience with 3commas trading bots before Binance withdrew service from Canada.

I recommend BitGet Copy Trading as an option to consider as well.

Thanks for tuning in:

Trade safe and keep those losses small.